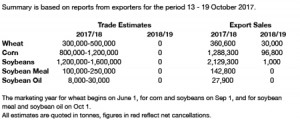

- US export data has been released as follows:

- Chicago markets have been both mixed and dull today with only better than anticipated corn and soybean exports adding support, and weak sales together with an absence of fresh news input pressuring wheat prices. A plethora of global wheat tenders announced today are likely to limit further price erosion, certainly in the short term. Those tendering include Ethiopia, Jordan, Saudi Arabia and Taiwan.

- US export demand for corn included enlarged requirements from traditional destinations including Japan, Mexico and S Korea as well as a substantial volume for “unknown” destinations. US corn exports so far in October has exceeded expectations!

- China’s import quotas for 2018 are unchanged from 2017, and include 7.2 million mt of corn, 9.6 million mt of wheat and 5.3 million mt of rice. Feedgrain imports in September rallied slightly amid improving margins there. China also aims to embark on a more robust ethanol blending program, with a 10% blend targeted by 2020. This would of course require elevated corn consumption (potentially elevating imports), but would also cap feed imports amid higher DDG production.

- Also weighing on rallies is ongoing weakness in major exporting currencies. Brazil’s Real is down again to new three month lows. Australia’s dollar is inching lower, and following Canada’s decision to leave interest rates alone, the Canadian dollar has fallen 2% this week.

- It is clear that funds are, and will be, reluctant to take new positions until winter weather patterns are better known.