- Last evening saw Egypt’s GASC, once again, tender for wheat, on this occasion the shipment period was 1-10 October and the 13% moisture cap remained in place. Russia was successful in securing the whole of the business, one 60,000 mt cargo at a reported price of $190.07/mt

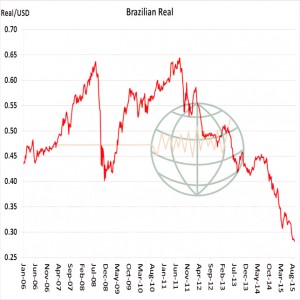

- We last night referred to the ongoing weakness in the Brazilian Real and the chart below illustrates the point. The Brazilian currency has shed 27% this year and seems to be targeting the prior record of 4.1 vs. US$. The implication is that the Brazilian farmer is enjoying extraordinary profitability despite Chicago soybeans at six year lows. Consequently we would expect Brazilian farmers to expand 2016 soybean acreage, maybe as much as 3-5%, which could see the crop grow as high as 103 million mt given favourable growing conditions. If this proves to be the case we will likely see further growth in global soybean stock, which are already high!

- It seems that Russian wheat output is still understated as current yield data starts to flow from the spring crop harvest. A crop north of 61 million mt, which is above the latest USDA number, looks entirely possible. Indeed, today SovEcon put the Russian total grain crop at 101 million mt with wheat accounting for 61.3 million mt. Exports are likely to also be high and potentially revised even higher as it seems that exporters are not yet hitting either desired or required volumes. The export tariff continues to ensure that Russian export trade remains a “spot” affair, and as the Russian winter approaches it is likely that exporters will want to maximise volumes before logistics become difficult.

- Russia’s total wheat supplies in 2015/16 appear to be heading for the second largest on record, and Russian wheat priced in US$ is incredibly cheap. The graphic below displays domestic prices across the Southern Region (the region that accounts for a majority of Russia’s exportable surplus) vs. quoted fob offers. As of early this week, wheat in Southern Russia is buyable at $149/mt ($4.05/bu), and exporters can sell this wheat into the world market at $181-185/mt for Sep/Oct delivery. This $30-35mtT spread is not uncommon and will allow exporters to remain aggressive with sales into North Africa and the Middle East in the foreseeable future.

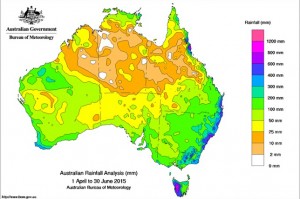

- Despite the looming threat of El Niño, the arrival of beneficial rainfall has helped prospects for the Australian wheat crop. The USDA’s current forecast for the 2015 Australian wheat crop stands at 26mt, 10% higher year on year. The rains arrived at a crucial point in the crop’s development with some parts of Western Australia, the major grain producing state, seeing the most rainfall in the past three months. Usually, El Niño brings drought-like conditions to Australia. So far, severe weather has not arrived but forecasters have warned that El Niño could strengthen towards the end of the year. There could also be wetter weather in Western Australia during harvest in November/December, which could potentially downgrade more of the wheat crop to feed grades.

- The International Grains Council (IGC) has today increased its monthly forecast for 2015/16 global corn output by 2 million mt to 968 million mt, which is behind last year’s 1.003 billion mt crop. Global wheat output was also increased by a massive 10 million mt to 720 million mt. Doubtless the information above (Russia and Australia) as well as the improved EU and Ukraine crop prospects (corn excepted) have contributed to their findings.

- Today’s market action has seen some recovery in Chicago corn and soybeans with wheat lagging behind largely as a result of aggressive Russian and E European offers to Egypt. The rally in corn and soybeans is based upon hot/dry E and S Midwest weather forecasts together with an improvement in nearby export demand prospects (at last!).

- The USDA has today released its weekly export figures as detailed below:

Wheat: 529,600 mt, which is above estimates of 225,000-400,000 mt.

Corn: 854,800 mt, which is within estimates of 500,000-900,000 mt.

Soybeans: 1,325,800 mt, which is above estimates of 600,000-1,050,000 mt.

Soybean Meal: 149,900 mt, which is within estimates of 50,000-275,000 mt.

Soybean Oil: 35,100 mt, which is above estimates of zero-30,000 mt.

- New crop corn and soybean sales were better than expected and have been seen as supportive, as the market has reflected. There is also a sign that China is starting to look at the US as an origin for soybean supplies as S American prices start to become less competitive when compared to US levels.

- Brussels has issued weekly wheat export certificates amounting to 319,410 mt, which brings the season total to 3,399,289 mt. The season to date total is 94,131 mt (2.85%) ahead of last year.