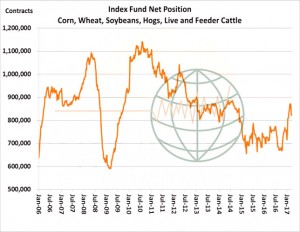

- Managed funds are now holding their largest net short grain position heading into a N Hemisphere growing season on record! Funds have been adding to their net grain shorts and shedding length in soybeans. Index funds have been holding their ag ownership, with a modest amount of liquidation heading into the end of the 1st quarter. We see no evidence that Index Funds won’t continue to hold their ag investment. The large net fund short position adds to the upside potential in the grains if adverse weather were to develop? It is premature to be overly bearish prior to the March Seeding/Stocks report.

- The morning saw Chicago markets higher on fund short covering as positions were trimmed ahead of the stocks/seedings report scheduled to be released on Friday. Seasonal price trends are higher on the back of a new growing season and farmers not liking current prices and avoiding new cash sales. The large S American corn and soybean crops are discussed to death and the market has digested them, they are no longer news! There is now a real need for fresh fundamental impetus to sustain trade direction; our view is that there is a strong pressure for fund managers to bank profits and take positions off the table as we head into quarter end. Will NASS find more corn and soybean acres as many are anticipating, we are not so sure but are not willing to bet heavily against.

- S Africa, the continent’s biggest corn producer is expected to harvest its biggest corn crop in 36 years at 14.3 million mt. This is up from a 13.9 million mt estimated in February. The last time that S Africa produced such a large corn crop was back in 1981 at 14.6 million mt. The makeup of the crop is 8.5 million of white corn and 5.8 million of yellow. The white corn will go a long ways to filling human corn needs into early 2018.

- The USDA Ag Attaché estimated the 2018 Canadian canola (rapeseed) crop at 18.5 million mt, equal to last year’s harvest. Such production would likely maintain end stocks at 1.0 million mt and it would keep canola prices firm relative to soybean oil or palmoil. We would expect that Canadian producers will plant an extra 5% to canola in 2017, which combined with a trend yield is likely to produce a crop of 19.2 million mt or more. Our feeling is that the Attaché is perhaps a little too conservative in their 2017 canola production estimate.

- New crop Black Sea wheat prices are offered at $174/mt which means that old crop is trading at a robust $16/mt premium ($.43/Bu). Russian 12.5% wheat is offered for April at $190/mt and farmers remain tight holders of stored supplies. Our bet is that new crop Black Sea wheat does not have much downside price risk below $170/mt until the 2017 crop is made. Russian fob wheat bottomed last year at $167/mt during the heart of their harvest. To become bearish fob new crop Black Sea wheat at this time is premature. One only has to look back to 2011 when Russian wheat exited dormancy in great condition, only to endure a dire drought in May/June which dramatically cut production.

- Chicago is trying to bounce from a technical oversold condition with the USDA Stocks/Seeding report due out on Friday. Historically, it is a rare year that the US or another major N Hemisphere exporter does not experience a few good weather scares during the growing season. With funds holding a record short at the end of March, our bet is that producers and traders will get new chances to sell corn, wheat and soybeans at higher prices. That said, one cannot be bullish until an actual weather concern is evident. Today, all looks good on the US and world weather front!