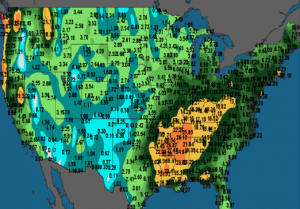

- It has been a “Tale of Two Cities” in regards of Central US weather during the 1st quarter of 2018. Heavy rain, often more than 18”, has dropped across the Delta and Southern Midwest while extreme drought persists across the Plains. The disparity is striking and based on the extended range forecast, this trend is unlikely to change. It will be important to see if the dryness in the Plains shifts north and east into June as forecast.

- Soybean futures traded quietly at midweek and settled slightly lower. Trading interest has been limited ahead of the USDA March report and rallies have been capped by funds looking to book profits ahead of the NASS Acreage and Stocks data. While soybeans and meal are trading well off the early month highs, soybean crush spreads are holding just under the highs traded five weeks ago. The May spread on Wednesday was at $1.47/bu, and on a seasonal basis is holding at a record level for late March. The July spread is also holding at a similar level at $1.44, with August at $1.37/bu. We estimate March 1 soybean stocks at a record large 2,055 million bu; however, strong crush margins are expected to keep processing rates record large into 2019. Our view stays neutral ahead of the US growing season, with spot soybeans to find support against $10.00 while a weather problem is needed to support a lasting rally over $11.00.

- Corn settled flat again, and there was little for the market to accomplish ahead of tomorrow’s flood of USDA data. There’s little doubt March 1 stocks will be record large, but more important will be whether farmers intend to plant at least 90 million acres in 2018. The USDA’s Outlook Forum guess (90 million this year) is rarely too far off, but there is a risk that intentions range between 88-89 million, which will provide strong support on breaks into mid/late summer. Also note US corn export sales Thursday should be a hefty 50-60 million bu. This week’s EIA data was mildly supportive in that ethanol production through March 23 was near unchanged on the week, and stocks fell 41 million gallons. They are now down 2% from this week in 2017. US crude production is record large, but crude exports continue to rise, and stocks remain some 20% less than a year ago. Overall, the incentive to produce/blend ethanol will stay intact throughout 2018. Volatility is expected on Thursday. It is too wet/cold in the Midwest, too dry in the Plains, and Gulf corn is competitively priced.

- May Chicago wheat has now retraced 85% of its Feb/Mar rally, and with the US Gulf market below other world fob prices, downside risk moving forward is limited. The next potential bear move requires confirmation of large Black Sea and EU crops, which won’t be known until July. Also, the US cash market is not showing evidence that current US wheat stock levels are burdensome. New crop cash basis is relatively strong. Funds are short an estimated 60,000 contracts in Chicago. The dry Plains weather pattern shows little sign of change in the next 30 days. Soil moisture in the far eastern section of the HRW belt will be improving, but a vast majority of HRW crop will be stressed under worsening drought conditions. Even SRW crop ratings need close watching amid a series of heavy rain events offered to the Midwest/Delta into mid-March. Egypt’s GASC is seeking optional origin (Black Sea) wheat for early May arrival. It is fully expected that Russian wheat will account for a bulk of the purchase, but the price paid is expected to be another seasonal high. NASS data won’t be overly insightful for wheat, but the spring wheat market does require a boost in acreage