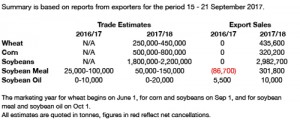

- US export data has been released as follows:

- Today’s action in Chicago (so far) has been largely lower and also somewhat dull with corn, wheat and soybeans all 1-5 cents lower at the time of writing. Grain export data was close to market anticipation, and even record weekly soybean demand could not spark anything meaningful, including fund buying. Key US data is out tomorrow, and our guess is that there is simply a lack of enthusiasm for new positions ahead of the release.

- Whilst it might be that corn export numbers were a touch disappointing, it should be noted that ongoing S American corn export volumes are at record levels. Soybean figures clearly reflect Chinese appetite for beans, from all origins, particularly at current (relatively low) price levels. It would seem prudent for both old and new crop Chinese soybean import volume figures to be increased somewhat.

- Corn demand shows little hope of improvement in the short to medium term, and it may just be that the USDA’s current US export estimate is too currently high. US wheat export prospects will only show signs of improvement once Black Sea export volumes start to reduce, potentially in December or January.

- The Australian weather forecast has added some rainfall for Queensland, but turned drier in NSW, which accounts for a much larger share of Australia’s total grain crop. Very heavy rain, 3 to 4 inches, is offered for Queensland this weekend, and will doubtless be welcomed, but other key wheat growing regions look set to remain dry into the first week of October. Aussie cash wheat continues to firm in price, particularly for higher grades.

- Demand for US soybeans is massive, but just how this impacts the balance hinges upon old crop carryover stocks, and whether yield is 50 bushels/acre or closer to 48, both of which will be determined in the next two weeks. Neutral prices trends are most likely into mid-autumn.