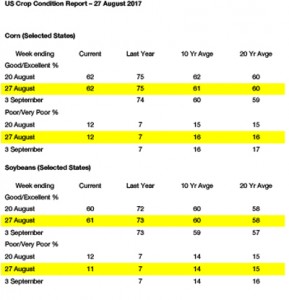

- US crop condition data was released last night as follows:

- Tuesday has seen a mixed Chicago market with neither the bulls or the bears able to capture the upper hand. We would suggest that there is something of a feeling of “bottom picking” season right now but it will likely be the impact of what is happening in the Russian market that dictates price direction in the next few days and weeks. S American corn exporters will continue to attract record demand, but traditional importers (Mexico, namely) no longer have much incentive to replace US corn with S American origin, particularly with Brazilian corn offered at or near parity with the US through December.

- Egypt secured 235,000 mt of wheat for early October delivery from Russia and Ukraine. Egypt paid $187/mt basis fob ($7/mt basis C&F below the last tender), which is generally in line with fob quotes Monday evening, and which confirms the Black Sea quality wheat market at $178-183/mt into November. US prices are a shade higher on the back of Harvey’s impact, but on paper US wheat is still very competitive.

- Crude oil is down $.60/barrel at midday, spot gasoline futures have rallied further to $1.76, EU wheat futures have settled weaker, though amid a new 2½ year high in the €uro, European cash grain markets will be little changed this evening. The market is largely ignoring new lows for this move in the US$, but we view it as important longer term.

- The market in recent weeks have been digesting larger than expected global supplies, Russian wheat has been especially surprising. Funds’ next move will hinge upon NASS’s September yield estimates, while the US wheat market is working to boost its share of world trade to a multi-year high.