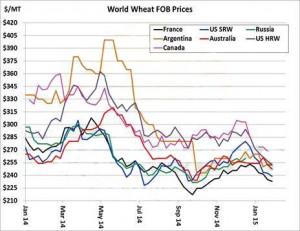

- Following from yesterday’s commentary on wheat and its direction going forward we thought it interesting to start tonight by looking at relative global wheat values, which are converging as sellers look for food or feed markets prior to the onset of the 2015 harvest. At present prices have been driven lower as EU farmers appear to be holding large stocks as we approach another large harvest. Focus will soon turn to new crop growing conditions and the autumn lows, which may provide support. The following graphic hopefully illustrates the point.

- We have commented many times on the wheat vs. corn price spread, and attach a chart illustrating the recent correction, which again hopefully adds to our recent thoughts.

- The USDA has today released its weekly export figures as detailed below:

Wheat: 565,400 mt, which is above estimates of 250,000-450,000 mt.

Corn: 1,084,200 mt, which is within estimates of 850,000-1,200,000 mt.

Soybeans: 909,000 mt, which is above estimates of 200,000-400,000 mt.

Soybean Meal: 297,500 mt, which is within estimates of 150,000-350,000 mt.

Soybean Oil: 10,600 mt which is below estimates of 15,000-30,000 mt.

- Brussels issued weekly wheat export certificates totalling 672,392 mt, which brings the season total to 17,726,982 mt. This is 454,748 mt (2.5%) behind last year’s record pace.

- US wheat sales were better than expected and have put a floor into todays market prices (despite the foregoing comments). EU cash wheat markets refused to move lower today, despite London and Paris futures drop this week, and the early weakness in Chicago saw new found competitiveness.

- Our thoughts are that we will see additional weakness in corn and soybeans into the weekend as hedge related selling in ahead of the advancing Brazilian soybean harvest takes hold. Crude oil has seen light selling and is close to recent lows whilst gasoline and ethanol follow, the US$ is stronger, Rouble and €uro are weaker. Front month soybeans came close to testing support at $9.96, which if broken will see further declines.

- Whilst we may have been looking for signs of a bottom in wheat, it has to be stated that right now there is no technical signal to confirm this, and as such why buck the trend? The old adage of “the trend is your friend” has to be borne in mind for now. In corn we have heard that Ukraine has approved 20.5 million mt of corn exports for the season, and is running about 3.5 million mt behind last year at this time. Our information is that importers should not bid for Ukrainian corn unless they truly want to own it – caveat emptor!