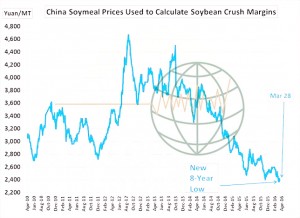

- Chinese soybean meal values declined to a new eight year low on Monday with their forward soybean crush margin at the lowest level since March of 2014! These extreme negative margins and China’s flotilla of soybeans that are afloat only look to worsen the supply situation. The only aspect of margin that is supportive is vegoil pricing which is tied to palm oil However, even China’s palm oil import margin has reached negative margins not seen since last September. The net result is that China will most likely pull back on soybean and palm oil imports, suggesting that the current soy rally has about run its course.

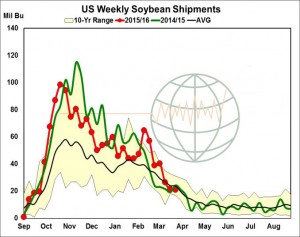

- Monday saw a mixed start to the week for the Chicago soy markets with May soybeans reaching a new rally high overnight, and then turning lower at the close. Soybean meal struggled amid weak cash markets while soybean oil found support from firming palm oil. US weekly soybean export inspections for the week ending March 24th were 20.9 million bu, but a new post harvest low. Annual US inspections now total 1,522 million bu and are now 7% behind a year ago.

- Chart based buying has been the dominant feature in Chicago as the trade prepares for Thursday’s USDA March Stocks/Seeding Intentions report. Fund managers continue to reduce their net short positions in corn and wheat, while they add to new market length in soybean oil/soybean futures. Note that soybean oil and soybeans are back to testing their recent rally highs with the RSI (Relative Strength Index) in each at its most overbought position since the wet weather rally last June.

- US vessel line ups show that China has just two soybean cargoes waiting to be loaded in the next week, and no new cargoes are currently indicated for the month of April. The US weekly export pace is going to decline sharply in the weeks just ahead to single weekly digits. Chinese demand for soybeans in either Brazil or Argentina is switching from the US with the harvest glut starting to arrive at Argentine port. Brazilian farmers are reported to have sold more than 70% of their 2016 soybean harvest.

- The key message as we see things is that once funds have stopped their short covering, which will likely happen in advance of this week’s USDA report, there seem to be few (if any) other buyers in the market place right now and we all know what happens when buyers are scarce or absent from a market – PRICES GO DOWN! The current Chicago rally remains highly technical with the market not seeming to care about China’s change in Farm Policy which would end their corn reserve purchase program and push an additional 20 million mt of feed grains back into world trade during the next crop cycle. We would expect that China will also end its soybean purchase program, and that its soybean seeding will be revitalised over time. Research argues that current Chicago corn, soybeans and wheat values are overvalued and that the past three week rally is more technical than fundamental.