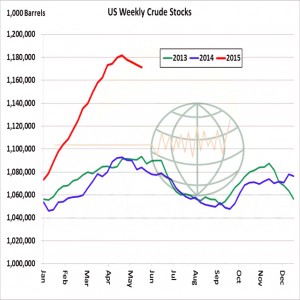

- US weekly crude oil stocks have started a seasonal decline, but from a historically high level. The chart below highlights the problem facing OPEC members at this Friday’s meeting: the world is awash in energy and producers are still trying to maintain their market share. We look for OPEC to hold its production level at a record high and that WTI crude futures struggle against $62-65.00. Also, we sees no reason why the €uro should continue its rally (up 2% Tuesday) and that by late summer or early autumn, the €uro will fall to be priced at parity with the greenback.

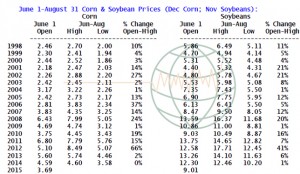

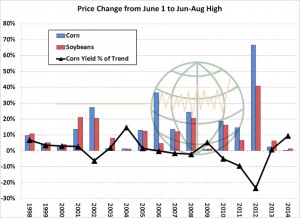

- The table above lists corn and soybean settlements on June 1st and high and low prices during the Jun-August period. Rallies occur every summer, but the question is: just what kind of advance can be expected, and at what point should summer rallies be rewarded? We view this as a function of weather, and namely potential US corn/soy yields. This is displayed in the graphic below, which charts the % change in prices from June 1 to seasonal highs in June-August and compares them to corn yield’s performance against trend. The most substantial summer rallies have occurred during years that corn yields falls sharply below trend. Otherwise, in years in which yield has met or exceeded trend, the average rally in corn from June 1 to the Jun-Aug highs is 8% – which in 2015 equals just $.30/bu. The average rally in soybeans rests at 7%, which in 2015 is equal to $.60/bu – $.16 of which was scored Tuesday!

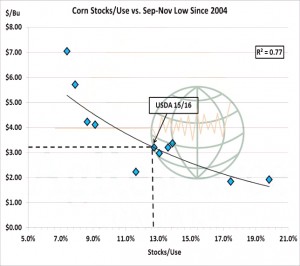

- We should also be mindful that in years when yield is above trend (2004, 2009 and 2014) summer rallies in corn and soybeans managed meager 1% gains from their June 1 settlements. With two-week and longer term climate forecasts indicating normal precip and temps across the US Ag Belt, it’s important for growers to reward even modest CBOT rallies with sales. Any test of $3.95 Dec corn and $9.40 Nov beans are targeted unless a quick and rather dramatic weather pattern shift emerges. Heavy new and catch-up sales will be advised by many on such a normal price recovery. The graphic below displays corn stocks/use vs. autumn lows, and assumes the USDA’s estimates in the May WASDE – which are a bit optimistic with respect to new crop consumption. This model suggests lows will be posted at $3.00-3.20, and indeed there’s a strong correlation that price corrects from summer highs with lows in August or at harvest. Finally, a 2% recovery was posted Tuesday in corn/soy futures which has met the minimum amount required in above trend yield years. Our bet is that December corn struggles above $3.85 and November soybeans above $9.25.