- One of the benefits of a long holiday weekend is the opportunity to think and reflect, as well as enjoying a well earned tipple! Our weekend reflection left us asking, “What do we REALLY know?” Simple, was the eventual conclusion, The World Is Awash With Grain!

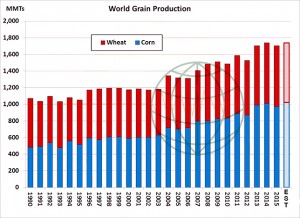

- The world has too much grain! Combined 2015/16 world grain stocks are record large in 2015/16 at 450 million mt. The growth in stocks will likely continue in the 2016/17 crop year without a new crop weather problem. The grain rally in Chicago has to be betting on a sizeable supply disruption due to adverse weather! The fundamentals of US and world grains are relatively clear – one of oversupply. The world will likely produce another large wheat crop in 2016/17 with produciton in Russia, US, Australia and even Argentina to expand from last year. The EU wheat harvest could near last year’s record with normal weather. Note that combined world corn/wheat stocks have risen in each year since the 2012 US drought as supply is rising faster than demand. The maturation of world bio-fuel demand and slowing world wheat trade has allowed for vigorous stocks growth. There is no sign that such growth is ending .

- Our projection of 2016/17 world wheat production at 718 million mt is down 15 million from last year’s record of 733 million mt. Much of the decline was due to unfavourable growing weather in Ukraine during the autumn seeding. However, world wheat crops are doing so well under favourable weather conditions that a harvest of 722-730 million mt is becoming more likely. Our 2016/17 world corn estimate is 1,021 million mt, up 49 million mt from last year, a record. The world has no shortage of feed grains. Combined world corn and wheat production rests at 1,739 million mt – also a record. Also, barley beats the 2014 record at 1,738 million mt on additional seeding. The chart below reflects combined 2016/17 world major grain stocks and that a new record high will be set in the 2016/17 crop year.

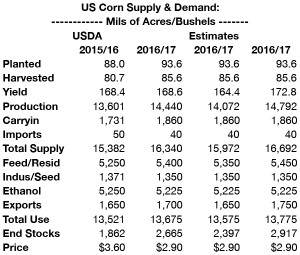

- Even the US corn balance sheet is likely to expand in 2016/17 with a yield loss of more than 5% needed to justify a stocks total below 2,000 million bu. This would be a US corn yield of just 160.5 bushels/acre or less to produce any justification for December 2016 corn futures to muster a rally above $4.00/bu. The table below reflects our 2016/17 corn balance sheet using a trend line yield of 168.6 bushels/acre, and yields that are 2.5% above and below trend. The 2016 US corn crop is off to an early start in solid soil moisture. Although the market is broadly talking about La Niña, the real world is that a new record US corn yield cannot be ruled out with normal weather into pollination. Our point is that world grain supplies and stocks are abundant and there is little fundamental reason for a further rally.

- The latest US crop condition and progress report showed winter wheat condition at 61% good/excellent, which is 1% above expectation and up from last year’s 43%. Spring wheat is 54% planted, behind expectations of 57% and down from last year’s 69% but above the five year average of 39%. Corn is now 45% planted, behind expectations of 47%, unchanged year on year but above the five year average of 30%. Soybeans are 8% planted, behind last year’s 10% but above the five year average of 6%.

- Informa Economics have released their latest 2015/15 S American crop estimates as follows:

Brazilian soybeans 100.1 million mt, down from 100.5 last month.

Brazilian corn 81 million mt, down from 83.7 million mt last month.

Argentine soybeans 55 million mt, down from 59.5 million mt last month.

Argentine corn 27.5 million mt unchanged from last month.

- In Chicago markets today soybeans and soybean meal had a strong early rally but a stronger US$ and falling crude oil left the rally faltering and failing as the day progressed. The reversal in fortunes is being viewed as “technical” in nature and could well persuade funds to slow, halt or exit fresh long positions, and there is some evidence already that profit taking is under way. Charts also suggest that the grains, wheat and corn, could well have seen season highs although we will have to wait for time to pass before this can be deemed to be fact. The slowdown or halting of the last three weeks’ fund purchase onslaught could well leave the market searching for a new buying force, which if found to be absent will likely point the way lower for prices.

- The ongoing US wheat quality tour is reporting lush crops with high yield potential (see crop condition above) and some are already asking if Kansas may even set a new yield record, the current record stands at 45 bushels/acre from 2010. There are suggestions that the US could produce a total wheat crop close to last year with some three million acres less to be harvested.

- Despite S American crop losses that have been/are widely discussed and digested and Chinese showing limited appetite to chase the recent hike higher in prices, as is also the case in Europe, markets could well be close to or even past their season highs.