- The USDA has today released its weekly export figures as detailed below:

Wheat: 277,900 mt, which is within estimates of 250,000-500,000 mt.

This year 277,500mt; Next year 400mt.

Corn: 441,000 mt, which is below estimates of 500,000-900,000 mt.

This year 112,700mt; Next year 328,300mt.

Soybeans: 1,472,300 mt, which is above estimates of 550,000-950,000 mt.

This year minus 60,500mt; Next year 1,532,800mt.

Soybean Meal: 204,500 mt, which is above estimates of 50,000-200,000 mt.

This year minus 13,900mt; Next year 218,400mt.

Soybean Oil: 6,100 mt, which is within estimates of 5,000-40,000 mt.

This year 4,000mt; Next year 2,100mt.

- Brussels has issued weekly wheat export certificates amounting to 272,705 mt, the lowest weekly figure this year. This brings the season total to 3,617,994 mt, which is 318,084 mt (nearly 8%) behind last year.

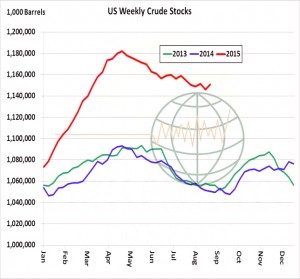

- Sticking with the macro picture we see large US crude oil stocks capping rallies as the seasonally slow period for demand arrives. The summer driving season ends with the Labor Day weekend. Research sees the crude oil market in a bottoming pattern with support noted under $42 and rallies to be capped inn the range of $53-55.00. Shale producers have break evens around $50, and there is talk that OPEC may vote to trim production by year end to prevent an even deeper correction. The point is to come away from bearish crude bets and expect a swinging market profile within a general $40-55 range into 2016.

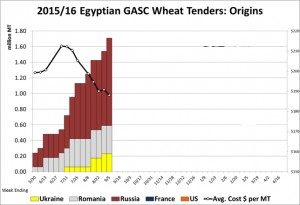

- Egypt has tendered for wheat once again, this time for 11-20 October shipment, and in the million plus mt offers it was Russia who once again secured the entire 170,000 mt business at a price almost £3.00/mt below last week, reported to be $188.02 basis C&F. France offered the cheapest FOB price $174.74/mt in a 400,000 mt plus offer whilst Russia was a bigger seller and more than $4.00.mt basis FOB more expensive – but freight costs pushed the business away from France. Romania and Ukraine were unsuccessful offerors and nothing was on offer from the US.

- StatsCan today released its latest data which showed end July wheat stocks 32% down year on year (20 year highs) at 7.11 million mt, which was above trade expectations that stood at 6.5 million mt. Canola (rapeseed) stocks were put at 2.32 million mt, again above the 1.4 million mt trade estimate but below last year’s 3.01 million mt figure (a four year high).

- Staying with stats, AgroConsult put the Ukraine 2015 grain crop at 57 million mt, a 600,000 month on month increase with wheat accounting for 24.2 million mt (1.7 million mt up month on month). Corn output was less optimistic with the latest update 1 million mt lower month on month at 23 million mt.

- Informa Economics has estimated 2015 US corn output at 13.688 billion bu vs. their previous estimate of 13.412 with yield increased to 168.8 bushels/acre from 165.4 previously. Soybean output was estimated higher at 3.924 bushels/acre compared with 3,789 previously with yield at 47.0 bushels/acre vs. 45.4 previously.

- In other news, China is closed today and tomorrow to celebrate the 70th anniversary of the ending of World War 2, maybe some market respite will follow, maybe not! However, despite closure, the IMF warned that the impact of Chinese lower growth on the rest of the world would be worse than previously thought. They said, “China’s transition to lower growth, while broadly in line with forecasts, appears to have larger than previously envisaged cross-border repercussions, reflected in weakening commodity prices and stock prices. Near-term downside risks for emerging economies have increased.”

- To counter Chinese news, Europe is growing as demonstrated by the Eurozone composite purchasing manager’s index (PMI), which improved to 54.3 in August from 53.9 in July, which signals accelerating growth. Whilst global economic worries have grown recently, the reduced fears of a Grexit have led to an improved European business environment, pushing the pace of growth to its best in just over four years. However, as always the news is not entirely as it may seem on the surface. Growth across Europe is not uniform, on the one hand we saw German PMI jump to a five month high of 55.0 and both Spain and Italy also saw improvement. On the other hand France saw PMI fall to a seven month low of 50.2 and that is a worrying sign of stagnation.

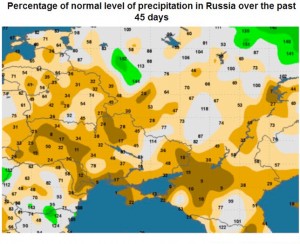

- We have previously mentioned that Russia fears another dry sowing period for winter wheat as dry weather over the past few weeks and soil moisture levels are lower than average for this time of year, according to analysts at SovEcon. There are concerns that the lack of rainfall will delay the planting of winter wheat, which already has a tight planting window. However not all is lost, as spring wheat is yet to be sown for which there is still time for the weather (winter rains in particular) to improve. Despite the dryness, SovEcon have reported that 3.2 million ha of land has been planted to winter grains, which is ahead of last year’s pace. The South, which is suffering the most from low soil moisture still has some time left before the planting window closes, with 10-25mm of rain forecast over the coming two weeks. However, more rain will still be needed in many areas.