- The graphic below highlights the “silver lining” of falling grain prices! US ethanol margins have been rallying steadily since late summer, and there is even a modest incentive given to ethanol blenders, basis spot prices. Also, in the cash market, calculated margins are some $.10/gal above ALL costs, and so the market is working to clear excess supplies. US corn end stocks look likely to stay north of 2.0 billion bu, and no doubt a record crop will harvested this autumn. It is just that with prices at multi-year lows, and the goal of the market to find/boost consumption this is being accomplished slowly but steadily. Supply data will have been fully digested by early September, and focus thereafter will be placed upon US demand and S American seeding intentions.

- We should note that Egypt made their third wheat tender of the season last Friday and secured 180,000 mt from Russia for late Sep/earlyOct shipment at a reported price of $185.52/mt basis C&F, which is more than $8.00/mt above the 12 August tender. The market on Monday was sharply lower on further news from Egypt, this time they have reverted to a zero tolerance policy on ergot contamination. International acceptance standards permit 0.5% contamination but Egypt has once again adopted their last season (partial) zero tolerance. This will push their costs higher as exporters only commit with reluctance as the costs of rejection are so high, in addition the absence of France (so far) from international line-ups will further restrict Egyptian options.

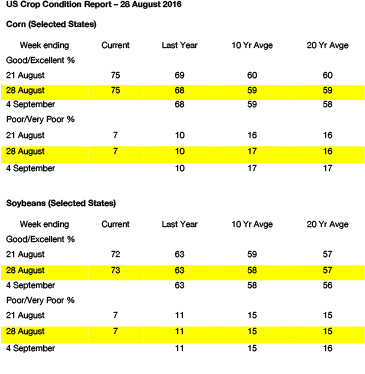

- Monday saw another week of what could best be described as excellent US crop condition ratings, which spurred weakness, and this has been followed today. We remain in the grip of the supply side of the equation and many are speculating on a boost in soybean yield in the September USDA crop report. The ProFarmer tour results, released late on Friday, placed yield at 49.3 bushels/acre, higher than the USDA’s August estimate, and the weather appears to remain favourable potentially seeing further yield upside prior to harvest. It is interesting to note that on an historic basis the ProFarmer estimates have tended towards under rather than over estimation.

- The tour corn yield estimate was reported at 170.2 bushels/acre, below the USDA by 4.9 bushels/acre, which if proven correct would see end stocks a touch below 2 billion bu. However, the market was not shaken and Monday saw the fifth consecutive lower close and Friday saw new contract lows.

- The US markets are suffering some pain right now as they dip yet lower searching for price levels that will trigger a demand led recovery. August is traditionally a weak period for soybean and grain markets, it seems that the US is moving back towards becoming a dominant exporter by mid-autumn.