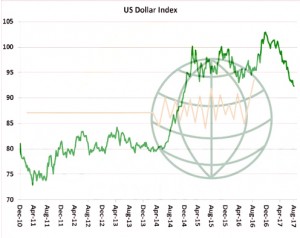

- The US$ this week has hit new lows for the move, while the €uro rests at multi-year highs. This is an important development, longer term, for seeding in 2018 and beyond, and currencies, along with flat price, are now offering much less inventive to expand acreage in S America, among other places. A close below 91 point is viewed as further bearish, and currency action in the next few weeks needs close watching.

- September corn has reached $3.30/bu while December corn futures have fallen near $3.45. November soybeans are trying to test support at $9.30 while wheat is holding near unchanged. The market maintains a bearish feel with the charts technically oversold, but still heading lower. Bottom pickers have not been rewarded, and the market may have to get beyond first notice day to spark a recovery. US elevators report that farmers are still existing stale cash basis contracts in corn and soybeans. The selling from these elevators and ethanol groups should be completed by Thursday. A portion of the decline is based on fund selling and the ongoing liquation of long cash connected contracts.

- Stats Canada will release its August crop report Thursday morning. We expect Stats Can to reveal Canadian wheat production at 24-25 million mt, with canola production estimated at 17.8-18.5 million mt. USDA pegs Canada’s wheat and canola harvests at 26.5 and 20.5 million mt, respectively. Canola futures this week have followed the soybean market to very marginal losses, but canola maintains a premium of $55/mt to soybeans, vs. a slight discount on this week a year ago. EU wheat farmers are voting with their actions to curtail cash related selling. Although the spring grain harvest is underway in Russia, cash sales here are also declining amid low prices. A trend of reduced farmer sales is a theme that likely to persist into October. Producers are unwilling to take a loss and sell cash grain/oilseeds at these depressed levels.

- A new tropical storm has formed in the Atlantic and it is named Irma. The storm is expected to take a westerly route and then turn west southwest on Friday. The exact storm path thereafter is up for debate with many of the computer taking the storm in different directions. Following on the heels of Harvey, we are sure that the media will be paying close attention to Irma next week. Delta farmers are at risk from heavy rains with crops ready for harvest. The Delta corn harvest has been accelerating while soybeans are close behind. Gulf exporters are counting on the Delta soybean harvest for nearby supply.

- Cash connected and fund selling is keeping pressure on Chicago at midday. A year ago, Chicago markets bottomed on Aug 31st as basis contract selling ended for old crop. Field surveys argue for smaller US corn and soybean yields from NASS.