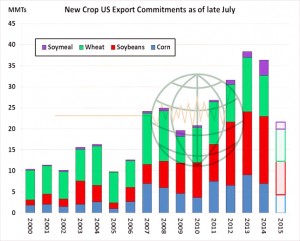

- Last night’s soybean and wheat exports sales were better than expected, and improved on recent weeks. But broadly, 2015/16 sales remain well behind recent years, and in fact, the discrepancy between last year and this year is growing. Total corn, wheat, soybean and meal commitments for the 2015/16 crop year stand at 21.6 million mt, down 41% from last year. A week ago this discrepancy was 40%. This is due to large corn and soybean purchases in the same week last year, and generally, new crop soybean sales in July of 2014 ranged from 1.0-1.3 million mt per week, vs. 200-900,000 mt this year. We are concerned that S American soybean/corn exports are cutting into the US’s window of opportunity, with China already booking 6-7 million mt of S American soybeans for Sep-Oct-Nov delivery. US export demand is fading on expensive Gulf fob offers.

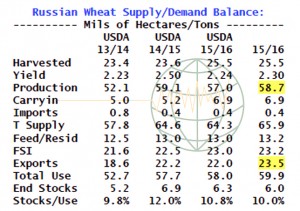

- Russian wheat prices have fallen to test spring lows. This is behind the decline in US and European wheat futures, and even amid cheap prices, Black Sea exporters are struggling to find new business and Russia’s export tariff uncertainty has caused the market to be mostly one of hand-to-mouth buying, as evidenced by recent Egyptian tender results. Wheat yield estimates from Southern and Central Russia continue to surprise to the upside, and weather across the Volga and Siberian regions (where spring wheat is grown) has been favorable in July. Normal precipitation and temperatures are projected across Siberia and other spring wheat areas in Russia for the next two weeks. It seems prudent to raise our Russian all-wheat production forecast to 58.7 million mt, up 1.7 million mt from the USDA’s estimate in the July WASDE. Exports, too, will likely be raised on greater supplies.

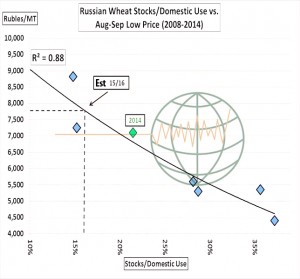

- We would wish to highlight the importance of Russian supply, demand and price for the world market, and it’s well known that Russian fob offers are a benchmark for other markets in summer and early autumn. Russian prices, in turn, are largely a function of their exportable surplus. The graphic below illustrates the correlation between domestic prices and ending stocks as a percent of domestic use. Russia has held bigger surpluses in the past, but the plunge in the Russian Ruble has limited any fob price rally. The low so far in domestic markets rests at 8,900 Rubles/mt, which is above the 7,750 Ruble price projected by the model, with stocks/domestic use pegged at 16%. However, we fear additional losses in Russian prices are in the offing as spring wheat harvest nears. About 50% of Russia’s wheat crop is winter and 50% is spring. Even current domestic prices at 9,000-9,500 Ru/mt are equivalent to $4.10-4.50/bu and Russian fob offers will remain the world’s cheapest in the foreseeable future.

- Despite being seemingly cheap at $4.10-4.50/bu, Russian prices in Rubles are up 40% from last year’s harvest lows. Producers will receive more revenue this year and with planting decisions to be made in the next 2-3 weeks, we expect expanded winter seeding for 2016. The graphic below charts the Ruble as well as spot CME wheat futures prices in Rubles since 2005. In Rubles, domestic Russian wheat prices hit an all-time high in late 2014.And they are perched near multi-year highs today. There’s little doubt that this will incentivise Russian producers to expand acreage in 2016. Assuming trend yield, another Russian harvest of 56-62 million mt can be expected in 2016, with exports ranging from 22-25 million mt. Currency has become a very important consideration in any long term supply outlook in world wheat. US wheat exports will suffer as a result.

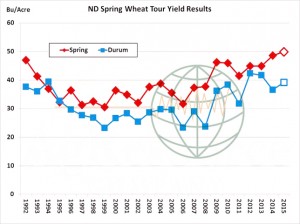

- As an aside, the North Dakota wheat tour has ended, with spring yield estimated at 49.9 bushels/acre, a record for the tour. The durum yield estimated at 39.2 bushels/acre, not a record but up 2.6 bushels/acre on last year. Harvest lies just ahead. US export sales through the week ending July 23rd totalled 25.7 million bu, a marketing year high, with improved interest for HRW and HRS. Only traditional destinations are noted, but the week’s business is modestly above the pace needed to hit the USDA’s target. However, we doubt that the pace can be sustained amid ongoing discounts in Europe and the Black Sea. The Aussie forecast has eliminated rainfall in Eastern areas, which warrants monitoring amid a still-developing El Nino. Otherwise, we advise a more neutral outlook into August as Black Sea prices have stabilised – and the quantity of high quality Russian milling wheat is still being debated. However, sub-$5.00 futures will need to be sustained to attract better US exports, and generally more work needs to be done to encourage higher total consumption.