- Crude oil prices fell to sharp losses in recent weeks on oversupply and waning demand. The chart below reflects our expectation that spot crude should bottom between $42-44.00. US rig counts are up and OPEC members are still pushing for world market share. If the $42.00 level is taken out, the next downside price target would be the 2008 lows at $32.50. We have previously suggested that fracking and the new advances in oil extraction argue for spot crude oil to trade between $35-80.00 for many years to come as the market adjusts to the US becoming a net exporter.

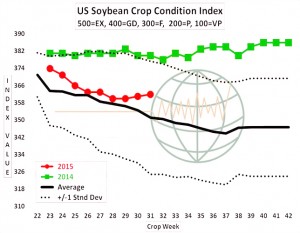

- US soybean good/excellent ratings rose 1% to 63%. The sunshine, warmer temperatures and rain across the W Midwest has helped US soybean yield potential. Note that seasonally US soybean ratings tend to decline from early July into August. Such a decline in ratings has not occurred this season, which argues for US soybean yields rising to near or above trend levels. If the ratings keep rising into mid-September due to favourable weather, the US can still produce a 2015 US soybean yield above 46 bushels/acre. Such production with a fall in US soy exports could lift 2015/16 soybean end stocks to 500 million bu or more.

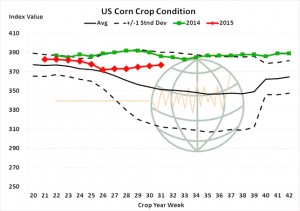

- US good/excellent corn ratings as of Sunday were 70%, unchanged on the week. However, the crop condition index, which accounts for all rating categories improved 1 point to 376 (down just 2% from last year). The ratings have rallied steadily since early July, against the seasonal trends. As such, we believe that it is justifiable to raise projected final US corn yield by 0.5 bushels/acre to 166 bushels/acre. Coming rainfall and a lack of heat will likely maintain high ratings into the middle of August.

- US spring wheat condition ratings were unchanged as of Sunday, with 70% of the crop pegged as good/excellent, and conditions across the Dakotas are the upper end of the historical range. Spring wheat harvesting has reached 8% complete, vs. 3% a year ago. A seasonal bottom is slowly being formed in non-US fob prices which should offer support to US markets on breaks. The Australian forecast is dry into mid-August, which should be watched, but without lasting heat/dryness, CBOT spot futures are fairly priced in a range of $4.80-5.30.

- Chicago has seen light volume trade today in a feeble attempt at a “Turnaround Tuesday” which saw wheat ending lower with corn and soybean just in positive territory. Buying from consumers is limited and it is traders looking to either bank profits or reduce risk ahead of the raft of private forecasters data in coming days.

- There are strong rumours in Asia that China is about to change its minimum price policy on grains. China has supported corn and wheat at prices that are relatively high in relation to world levels and this has promoted additional domestic soybean meal consumption. The Chinese authorities appear to be looking for ways in which to reduce the cost of storage and waste, and is expected to move towards a target price system with direct payments to farmers. If implemented this would lead to plummeting Chinese feed prices and very likely significantly reduced volumes of imported feed grains.