- Starting tonight’s update with Europe it was interesting to note the MATIF wheat was down €3 for most of the day, with London correspondingly low, before bouncing €2 off its lows, and unusually it is difficult to see why. The price uptick happened prior to the release of Brussels export data as well as the 140 point rally in the Euro on the back of President Mario Draghi’s comments. Weekly wheat exports reached 761,129 mt, which brings the season total to 13.52 million mt, 1.15 million mt (9.3%) ahead of last year’s record pace. EU corn imports for the Oct-Sep season reached 882,000 mt with the week seeing 231,000 mt imported. Last year’s comparable figure stood at 2.262 million mt, which highlights the year on year swing in appetite for corn. However, this weeks import figure marks a season high, and may well be the first sign of awareness of the relative cereal prices with corn starting to look cheap once again. The trend is worth watching as any significant increase may well place adverse pressure on wheat end stocks, with all that this entails.

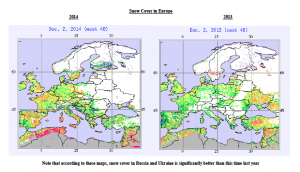

- For those who have proclaimed doom and gloom over Russian and Ukrainian cereal crops suffering extreme cold and lack of snow cover, the following graphic may ease the fears somewhat. According to our sources there is little in the way of seasonal anomaly and snow cover is generally pretty good.

- CBOT prices started the day in defensive territory before US weekly export data was published which showed soybean and corn exports to be larger than expected which triggered a move higher. Full figures are as follows:

Wheat; 313,200 mt which is within estimates of 300,000-500,000 mt.

Corn; 1,170,600 mt which is above estimates of 600,000-800,000 mt.

Soybeans; 1,179,800 mt which is above estimates of 650,000-850,000 mt.

Soybean meal; 227,200 mt which is above estimates of minus 50,000-plus 60,000 mt.

Soybean oil; 25,100 mt which is within estimates of10,000-30,000 mt.

- StatsCan released their latest figures which showed the 2014 all wheat crop1.8 million mt higher than previously estimated at 29.28 million mt which was above trade estimates of 27.8 million mt although below last year’s record 37.53 million mt. The canola (rapeseed) crop was seen at 15.56 million mt below last year’s 17.97 million mt but still the second best figure on record. This latest update was1.46 million mt above StatsCan’s previous estimate and above trade estimates of 14.6 million mt.

- Finally, there has been a suggestion that the Argentine government is to limit credit offered to farmers who hoard soybeans – our take on this one is struggling to get into print!