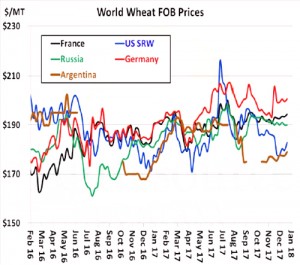

- Argentine FOB wheat prices are once again the cheapest in the world as the US market has turned higher following the current arctic chill and potential freeze damage that may have harmed the Plains HRW crop. Notice in the graphic below, US SRW wheat prices are still well below all other world exporters, which offers the potential for additional gains. We would note that European wheat exports to date are exceptionally slow, and at some point when French farmers start to unload their stored cash wheat, the EU will become a more aggressive world wheat exporter. US cold weather cannot bull the world wheat market it seems.

- It seems that several days of gains are unwinding in Chicago as corn, wheat and soybeans all sag this morning. Traders are debating sluggish US corn, wheat and soybean export volumes and whether 2018’s S American corn and soybean output will reach last year’s volumes – or not. The USDA’s last WASDE put 2018 Brazilian soybean output at 108 million mt and Argentina at 57 million mt. The trade consensus appears that the Brazilian crop will be 2-3 million above the USDA’s last and that Argentina will be below by 1-2 million. The net result being a combined harvest in the order of 165-167 million mt, which is below last year’s 172 million result. In a market enlarged by greater global demand a crop of this size would put support into market prices, and we would estimate that level at $89.50/bu basis spot Chicago futures.

- In corn the argument is even stronger with Argentina’s crop seen at 39-40 million mt, some 2-3 million below the latest WASDE, and many doubtful that Brazil will produce 92 million mt. Combined corn output of 129-131 million mt would be some 8-10 million below last year.

- Hedge fund managers see Chicago grains as a cheap play and they could become larger investors following the Jan 12 USDA Crop Report. The macros are bullish for raw material prices. The Baltic’s main ocean freight index surged 6.25% today to $1,341.00. 2018 World freight rates/indexes have been rising amid strong demand for raw materials from emerging nations. The trend is likely to persist into Q2.