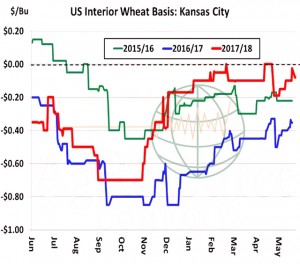

- KC cash wheat basis has entered the new crop year at its best levels in four years. Kansas HRW cash wheat basis is just below par with spot futures, a big departure from recent years heading into harvest. Note that cash KC wheat basis seasonally declines from early June into September amid the sharp rise in supplies. However, this year the basis decline is expected to be less amid a higher protein wheat crop and the ongoing loss of Black Sea and European protein wheat. The world is facing a shortage of hi pro which looks to underpin spot KC cash basis bids.

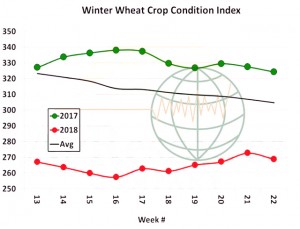

- HRW crop ratings fell slightly amid last week’s heat. Another downgrade is expected next Monday. There has been talk of better than expected yields being reported in the far Southern Plains, but it is much too early to determine even a regional trend. US winter wheat harvesting is 5% complete; harvesting in TX and OK is just 35% and 7%, respectively. We expect another blast of heat this week to take a further toll on yield. The US spring wheat crop is rated as 70% good/excellent, right on average. A needed weather pattern shift in the Black Sea is becoming increasingly unlikely. Just 20- 40% of normal rainfall is forecast is E Ukraine/S Russia June 1-18. Russian cash wheat prices are forming a bottom.

- It has been a mixed Chicago morning with soybeans trading both sides of unchanged while the grain markets are mostly higher. New speculative demand is noted in wheat as concern builds around 2018 Black Sea production. Corn has followed wheat amid Monday’s rise in open interest (funds selling short futures to hedge up long call options) while the soybean market is trying to better understand what President Trump’s position is on US/Chines trade. Notes that the volume of Chicago trade is being curtailed by US/Chinese trade uncertainty. Whether you are a bull or a bear, no one wants to be caught the wrong way in a tweet or tariff announcement. Until there is clarity on NAFTA and US/China trade, traders are going to curtail their risk. A tweet from President Trump can change the price complexion of Chicago markets dramatically.

- Chicago brokers estimate that funds have bought 3,600 contracts of corn, and 3,100 contracts of Chicago wheat. Funds have been on both sides of the soybean market and are net sellers of 1,200 contracts. In soy products, funds have sold 2,200 contracts of soymeal and 900 contracts of soyoil. The interest at midday is in decline.

- The EU monthly weather forecasts are out this morning and call for general dryness across the Central US for much of the next two months. There is no doubt that the EU model is drier than the GFS has been in the extended range. If correct, it would call for some real concern for 2018 US summer row crop yields. The EU long range model track record is far better than the GFS and it is something worth watching close in the weeks ahead.

- There are a lot of numbers floating around on how much US ag goods that China has proposed taking from the US. We have no way of knowing what data set is correct or what dollar amounts have been put out for media consumption. All we know is that a $1 billion secures a rough 3 million mt of soybeans. Thus, if China were to boost its ag spending $15-30 billion from current levels, it would be a big deal for US agriculture. This is the “carrot” for the Trump Administration, with the difficult aspect (of negotiations) trying to tie it together with intellectual property rights and the subsidisation of China’s rapidly expanding tech industry.

- The 11-15 day GFS Black Sea weather forecast has added rain with totals of 0.5-1.25”. This would be the best rain that the area has witnessed in weeks. However, confidence in such rain that far out is low. The rain will have to be pulled forward in the forecast to be reliable. However, we did want to advise that some needed moisture is possible, and that the extended forecast will have to be closely monitored

- The midday GFS North American weather pattern forecast is wetter with “ring of fire” rains across the N, C and E Midwest into mid June. Rain totals should range from .5-3.00” with locally heavier amounts. The driest area will be closest to the mean position of the ridge (in the Plains). Extreme heat of 90-100’s will be felt in the Plains and the W Midwest with spikes of similar heat into the Delta. The warmth is likely to persist into late June. We note that the GFS model has been too wet for some time, but because of the frequency of the rains around the ridge, some significant totals are possible. The midday model removed the risk of a tropical storm in the Gulf in the 11-15 day period with the ridge strengthening across the Midwest.

- The market is waiting for clearer signs on US/China trade, clearer signals on US and Black Sea weather, and clearer signs on what the US Government would do, if tariffs were placed to support farm income. With Midwest rainfall slated through early next week and the June USDA crop report due out next Tuesday, our bet is for continued choppiness in Chicago. Mid June is a critical time as this is when the US can enact $50 billion of tariffs on Chinese goods.