EU Wheat Evaluation

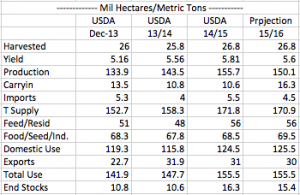

European exporters have flooded the market this year, following a sizeable surplus for the second consecutive year. How long will the EU remain a top exporter? In the table below, it is assumed acres are steady, trend yield and a slight boost in domestic use. Without a major weather problem in the next 2-3 months, Europe’s surplus looks to persist. This is partially a function of 5-year high carryin supplies. Spot Chicago futures are down 24% from March ’14. EU futures, however, are down only 14% as the €uro has struggled in the last three months. This has been a dominant theme in non-US markets: weaker currencies are partially – or more than fully, as in the case in the Black Sea – offsetting sharply lower CBOT prices. Lower EU wheat production in 2015 will be a function of yield rather than acreage.

EU Wheat Supply/Demand Balance:

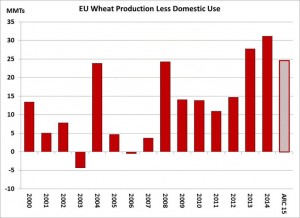

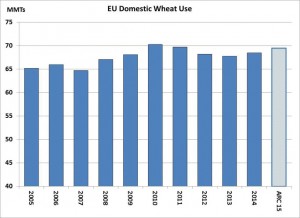

Projections show total European domestic wheat use in 2015 at 125.5 million mt, up 1 million mt from 14/15 and the highest since 2011. But notice in the graphic that domestic use has been rather stagnant in recent years. Since 2008, domestic wheat use in the EU has fluctuated in narrow range of 67-70 million mt, and gains in production have spilled directly into the export market. As of now, European exporters are trying to find any remaining old crop wheat demand to alleviate the projected 60% build in stocks – but to no, or at best limited, avail. Assuming production of 150 million mt in 2015 (unchanged seedings, trend yield) record exports are needed for sub-15 million mt ending stocks. And the European market in recent years has shown little concern over tight stocks/use ratios.

The initial new crop EU balance sheet features production 25 million mt above domestic consumption, down 6 million mt from last year. But this will be offset exactly by higher carry-in stocks, and so EU exports of 30 million mt in 2015 appears a reasonable estimate. Note also that Russia’s available surplus in 2015 is initially projected at 20 million mt. (Like the EU, lower Russian production in 2015 will be mostly offset by higher carry-in supplies.) Combined EU and Russian available exportable wheat supplies in 2015 are projected at 50 million mt vs. 51 million mt in 14/15. The US will again be a modest player in the world wheat market, and US offers must be much more competitive in the coming crop year to boost global market share. More and more work implies that highly adverse weather is needed to trigger any lasting rallies in the grains beyond periodic short covering.