- Global political tension levels have moved up a notch today in the wake of N Korea’s successful test of a Hydrogen Bomb. Anxiety levels within Asian and global financial markets have increased as the world debates what or if to do anything. The Chinese Yuan continues to depreciate with the Central Bank sets its value lower each day of this new year and it appears that investors are losing confidence in Beijing’s economic abilities.

- Informa Economics’ latest data release shows their estimate for the 2015/16 Brazilian corn and soybean crops unchanged month on month at 81.3 million mt and 101.4 million mt respectively. Their estimates for Argentinian corn are 1 million mt higher month on month at 22 million mt, whist the soybean crop is left unchanged at 58.5 million mt. Informa have also reduced their estimate of the Indian 2016/17 wheat crop by 4 million mt to 85 million mt.

- General market commentary:

Soybeans are oversold but with declining crude oil levels soybean oil is relatively overbought.

Corn markets have more selling to absorb in Brazil and Argentina remains active.

Wheat markets are responding to lack of weather issues from key exporters and this is keeping the trend down

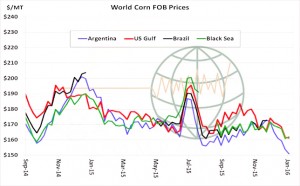

- Argentine fob corn prices have fallen to multi-year lows with offers at $151/mt with bids below $150/mt. This is now lower than the late summer lows of 2014 when Chicago spot corn futures fell to $3.20/bu. The US corn market is overvalued relative to the world which is why a pig producer is willing to import Argentine feed wheat into the SE US. Until there is a bottom in Argentine corn offers, Chicago corn will likely struggle to rally.

- Chicago markets saw an early decline but when Mar ’16 corn failed to breach $3.50/bu key support a short covering rally ensued. The market is only too well aware of the extent of the fund net short position and is consequently wary of a spike higher, and with the January USDA report scheduled for 12 January reduced exposure is the order of the day and this will likely lend some support or even a modest bounce ahead of publication.

- Global grain markets show little sign of vigour, Argentina’s corn and wheat offerings are steadier whilst French and Black Sea wheat offers are weaker. Global importers and consumers are showing little interest in adding to forward cover with books already well filled into spring and early summer.

- In summary, fund short positions offer the opportunity for a bounce but end users are unlikely to chase any rally in the face of current fundamentals and improving S American weather prospects.