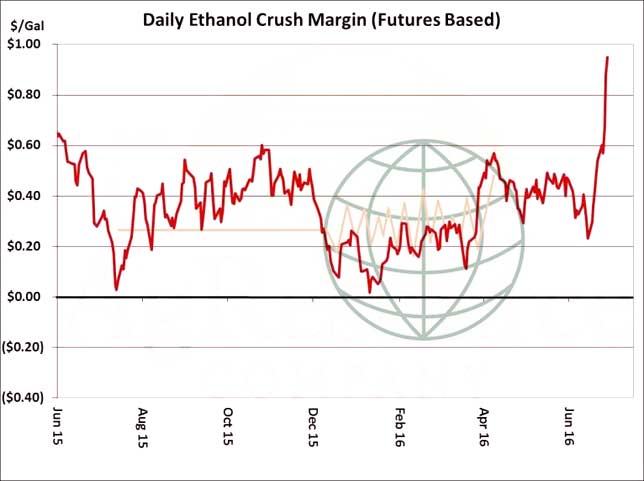

- US ethanol margins have soared on this price break with corn prices dropping nearly $1.00/bu in just the past two weeks. Near normal Central US weather and sticky cash ethanol prices have supported the big surge. Look for US ethanol plants to ramp up production amid $1/gallon margins. US corn yields have yet to be determined, but strong ethanol and livestock margins are likely to place a bid under spot corn prices.

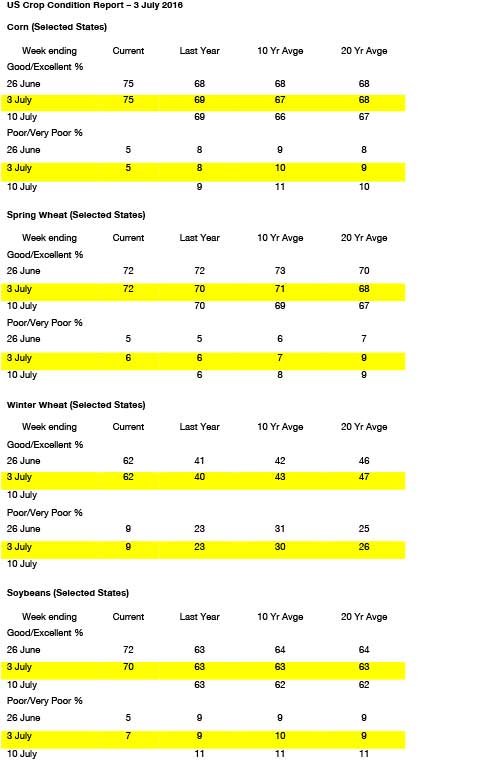

- Soybeans and meal keyed off of a deep break in Chinese meal prices overnight and gapped lower at Tuesday’s open. The sharply lower open was followed by technical selling/liquidation that had both beans and meal trading to limit losses. After the close, the Crop Progress report showed that 70% of the US soybean crop was rated as either good or excellent, down from 72% last week, but still well over last year’s 63%. Overall, crop ratings declined in 8 states, increased in 5 states, and were unchanged in 5 states. The best rated soybeans in the country are found in WI and the lowest are in MO and AR, but as a whole, the US soybean crop is still the 6th best rated crop on record, and assuming minimal changes over the next three weeks, yield models shows an August yield of 48 bushels/acre. November soybeans are back testing the May high, and our outlook has turned neutral on this break. Chinese soybean demand has been unrelenting, and US export demand will be strong in the coming months.

- Corn futures fell sharply, though ended well above session lows, amid weekend precip across the Southern Corn Belt, coming rainfall across Northern areas, and as competing grain prices in Europe and the Black Sea remain weak. Black Sea feed wheat offers have fallen to $157-159/mt for Aug/Sep, which is comparable to $3.10, basis Sep Chicago futures. A more neutral short term outlook is advised as US weather takes on much more importance during pollination, but we would be willing sellers of 20-30 cent rallies. The world is awash in grain. US crop conditions as of Sunday were unchanged at 75% good/excellent, vs. 69% a year ago. Declines are noted in MI, ND and SD; improvement is noted in CO, KS, KY, MO and OH. Rainfall of .50-2.00” into Thurs/Fri is likely to elevate ratings across the N half of the Corn Belt, and work still suggests a final yield of 168-173 bushels/acre. 15% of the crop is silking, and so weather in the next 10-12 days will have huge importance in determining yield, particularly temperatures. There is no threat currently, but the market will be especially sensitive to changes from weather run to weather run this week. Dec corn has reached our initial downside target of $3.50. Confirmation of above-trend US yield is needed to propel the market downwards. Rallies, however, will further curtail export potential. CBOT futures look to trade in a range from $3.40-3.80 into late month.

- US wheat futures rallied 3-8 cents, with spring contracts pacing the advance. It is estimated that funds in Chicago this Tuesday were short a net 120,000 contracts, the largest short position since April, and some measure of profit taking can be expected at or near contract lows. Russian cash prices fell another $1/mt for Aug-Sep delivery, with offers there comparable to $3.90, basis Sep Chicago. Russian crop estimates have centered on 65-67 million mt, a new record and compared to the USDA’s 64. We note that domestic prices in S Russia are beginning to collapse as harvest expands, and we reiterate that a lasting bottom on global market isn’t expected until early Aug. A slow grind lower in global cash grain prices is expected in the weeks ahead, and the US will have to follow to maintain market share. Russian cash prices will remain the market’s primary driver. US spring wheat crop conditions are unchanged at 72% good/excellent, right at average and vs. 70% a year ago. The spring crop is 74% headed (vs. 45% last year). Winter wheat is 58% harvested nationally, including 79% in KS. The wheat market lacks bullish fuel, though a more neutral outlook is forecast beyond the next 2-3 weeks.