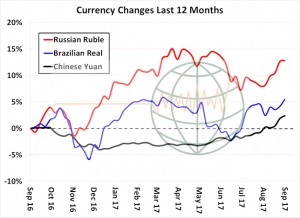

- World currency markets remain dominated by a falling US$ and strength elsewhere, as signs of economic growth reappear in emerging markets and as political uncertainty in the US does no favours for the US$. The graphic below shows that, in the last 12 months, the Russian ruble has rallied 12%, the Brazilian real is up roughly 5%. Even China’s yuan has recovered from early-year losses. Purchasing power in major importing countries is rising, albeit slowly, and the rally in major exporting currencies may work against further acreage expansion in 2018.

- Chicago markets have been somewhat more mixed today with the grains losing more than soybeans. Hurricane Irma continues to threaten although key crop regions appear, at present, to be spared some of the horrors experienced elsewhere.

- Europe has confirmed that it will allow imports of biodiesel from Argentina, which will act to replace lost US demand. A major shuffling of biodiesel/soybean oil trade flows is in the works, but work suggest lofty soybean oil prices are likely a longer term phenomenon. Argentine soybean crush will be salvaged, Argentine meal exports will be sustained, and oil’s share of crush is expected to rally further.

- The US$ has fallen to a fresh 2½ year low at 91.60. The €uro, ruble and Brazilian real are stronger, and despite ongoing political chaos in Brazil, former president Dilma is now accused of having run what is essentially an organised crime operation. Assuming today’s change in Brazil’s currency, cash corn in S Brazil is now pegged at $2.55/bu.

- The European Central Bank has again opted to leave interest rates unchanged. A rise in jobless claims in the US has tempered ideas of a further rate hike here in 2017. Russia this week has indicated it is planning some kind of rail subsidy, perhaps eliminating the current rail tariff altogether, aimed at accelerating grain exports. This, of course, will lower real transportation costs, which will help the farmer there, but won’t change Russia’s export capacity unless the subsidy is crop specific, namely if wheat shipments are favoured, it will provide more incentive to export wheat at the cost of barley and corn. More will be known about this subsidy after this week’s Russian Grain Union meeting.

- Australia’s forecast is still very dry through late September, and recall ABARES releases its September Aussie crop report next Tuesday. Trade estimates on Aussie wheat production range between 21-23 million mt, vs. the USDA’s 23.5. A much wetter pattern in late Sep/early Oct is needed to prevent further losses.

- Back and forth trading is expected into next week’s USDA and ABARES crop releases. We would caution that only slightly more objective yield data will be available to NASS than was available in August, and so major changes will likely await the October report, and actual yield data in late Sep will take priority.