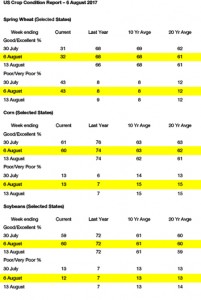

- US crop condition rating updates were released last night as follows:

- We have seen a mixed morning in Chicago with some weakness in the grains with soybean and products firmer. Short covering in grains appears to have slowed or ended and some of the “faster moving” funds are exiting soybean short positions. All and sundry appear happy to de-risk and reduce position size ahead of Thursday’s USDA report. There still appears to be a bearish mentality in corn and soybeans due to seasonal considerations and prior year performance, whether this is justified will be evident in coming weeks. However, what is true and not in dispute, is the ongoing dryness in the Midwest that has prevailed since mid June, and this could well transform the historic and seasonal picture.

- US corn, wheat and soybean stocks and stock/use ratios are both in decline, much different from recent years. The last time that an August rally evolved was back in 2012 when dryness struck the W Midwest causing reduced corn and soybean yield prospects. Until there is an improved weather outlook for Midwest crops, the downside CBOT price risk appears to be limited. There are 61 million acres of US corn and soybean ground that is short to very short of soil moisture. This is nearly double the amount of farmland that was dry in the past few years with crops in IA and C IL in immediate need of rain.

- The cool Midwest temperatures have helped diminish crop stress, but the time has arrived for rain. Corn and soybeans in some of the drier areas of IA are rolling leaves in the afternoon, even with high temperatures in the upper 70’s to the lower 80’s due to a lack of moisture. The point is that unless the Central US weather pattern changes quickly to feature rain, US crop ratings and yield estimates will be in decline following Thursday’s USDA August crop report.

- China imported a record 10.1 million mt of world soybeans in July with the crop year total pace exceeding the USDA annual forecast of 91 million mt with just 8 million needed to be taken in August and September. We are raising our 2016/17 Chinese soybean import pace to 93 million mt, up 2 million from the WASDE forecast. The 2017/18 WASDE Chinese soybean import forecast of 94 million mt, would only be up 1 million from the current year. It appears to be too low by 2-3 million mt. If WASDE were to raise its 2017/18 Chinese soybean import pace to 96-97 million mt, it would have to raise 2017/18 US soybean export estimates by 25-50 million bu to 2,175-2,200 million bu. This will be worth keeping an eye on in Thursday’s report.

- Updates from Canadian producer sources reflect a deepening and spreading drought across the Prairies. The yield losses are rapidly building. The all wheat crop estimate has fallen below 24 million mt with canola (rapeseed) below 18.5 million mt.

- Demand for world soybeans remains astounding and USDA will likely raise US exports in an old crop position by 35-50 million bu. Arid weather conditions for Midwest crops is causing new worry with soybeans now being the crop most impacted. The downside price risk in Chicago corn, wheat and soybean futures is limited amid declining US and world crop production totals. End users may well be hoping for a bearish USDA report, but may well find themselves running out of time.