- Midday comments:

- Overnight in Chicago wheat was near unchanged. There was early talk of a drier outlook across much of the Black Sea region as their plantings proceeded as well as reports of Russian export sales continuing to slow going forward. This news added some nearby support to the already buoyant wheat markets. Some are questioning quality wheat availability towards the second half of the season IF Russia does indeed slow exports. Whilst there is nothing like a global shortage of wheat we are likely to see a combined 2 to 3 million mt in Australia and Argentina (25.5 and 12.3 million mt respectively), and with funds still heavily net short this could place a strain on further downside, particularly in the short term.

- Corn eased fractionally overnight and the latest rally in Chicago leaves the US crop uncompetitive in the global market place right now. The bulls are encouraged by some wet weather, which is slowing harvest, and the technical nature of the latest market correction. For those US farmers who have been able to get into their combine and harvest, the yield reports continue to impress to the upside.

- Overnight soybeans were higher, again on reports of short covering ahead of Friday’s report. S American weather reports are somewhat mixed and merely add confusion into the marketplace resulting in a somewhat two-sided affair. US forecasts continue to offer a decent 8 to 14 day window of harvest opportunity, which will no doubt be welcomed, and seized with both hands by farmers anxious to get on with their harvest.

- Ahead of Friday’s report there have been concerns voiced over (significantly?) reduced corn and soybean acres, which does not feel quite right to us given the lack of major weather driven planting issues this season as well as prices that were high at the time of planting. Clearly we will be proved right (or wrong!) on Friday afternoon.

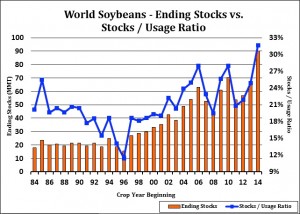

- We came across this interesting graphic showing projected world soybean carryout – a record – which we thought worthwhile including in today’s update.

- Evening update:

- Various pieces of data have been released today including:

- The Institute for Agricultural Market Studies (IKAR) in Russia have reduced their latest forecast for 2014 wheat output in the country by 1.5 million mt to 58.5 million mt, mainly as a consequence of delays to harvest caused by rain and some snow.

- French 2014/15 wheat closing stocks, as reported by AgriMer, are increased to 4.4 million mt vs. 3.9 million mt month on month, and are also up 88% year on year. Their corn figure stands at 3.7 million mt, which is a decline from 3.9 million mt month on month, but a 61% increase year on year.

- Lanworth has forecast the US 2014 soybean crop at 3,947 million bu with yield at 47.9 bu/acre, which is an increase compared with their last estimate of 3,880 million bu and 47.1 bu/acre. Their corn figure stands at 14,647 million bu with yield at 175.5 bu/acre, again an increase from their last figures which stood at 14,596 million bu and 174.9 bu/acre.

- Looking back on history, it is maybe of interest that fund movements in and out of positions tends to span a three day time frame. The current short covering spree started on on day, and is indeed showing some (slight) sign of petering out today. Today’s morning upswing saw a marked rise in farmer soybean selling which capped the upside somewhat. Grains have remained at their recent highs, but momentum appears to be slowing and we could well be looking at the pre-report “top”. Given the significant volume remaining to be harvested, and the fact that whichever way you slice and dice it, the US corn and soybean crops will be BIG, we find it virtually impossible to believe we have yet seen the season’s low just yet.

- Incoming yield data (apologies for harking on about it!) from the W and N Midwest remains record large, well above both records and grower expectations. As harvest progresses and more data becomes available it feels very much as if yields can not fail to hit 50 and 180 bu/acre for soybeans and corn respectively. Will Friday show that, “big crops do indeed get bigger”?

- In a meeting between Argentine grain exporters and the government yesterday it seems the government “insisted” that the exporters collectively invest $1.2 billion (as a loan?) in Argentina for their ability to export. It seems unlikely that the exporters will capitulate to such a strong-arm tactic and whether we will see government led grain exports in future remains a possibility (although unlikely). There seem to be little in the way of an end in sight to their ongoing economic and political chaos through which farmers, processors, exporters and the population as a whole have to muddle through.

- Our longer term thought process remains unchanged.