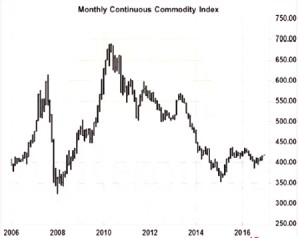

- The monthly CRB chart offers technical hope that the bear market in commodities (that started back in 2011) is changing. For just the 2nd time in recent years, the CRB closed higher for 2 consecutive months. A third month of higher close in November would spur additional demand into early 2018. Crude oil and metals have been the bullish stalwarts, but livestock and a few of the tropical soft markets have started to follow. The expanding world GDP looks to underpin the CRB.

- Following firm trade overnight, soybean futures came to life Wednesday morning and closed up 6-7 cents on technical buying. Soy product markets finished higher, with December meal finding support at the 50 day moving average, and gaining slightly on soyoil. Brazilian farmers were active with their soybean planting last week, with planting progress across the key producing states now estimated at 49% complete versus 34% last week and the 5 year average of 52%. Producers across the Midwest ran planters around the clock ahead of a wetter forecast for the early days of November. Farmers in the largest producing state of Mato Grosso now have 68% of their seed in the ground. By next week, we expect that progress should reach 63-65% and near 90% by the end of the month. We see January soybeans caught in a wide range, with support expected on breaks back to $9.70, while rallies back above $10.20 are sure to find farm selling as cash values near $10.00.

- Corn futures 5-day decline was halted amid further expansion in funds’ net short (open interest on Tuesday increased 25,000 contracts) and as US ethanol production continues at a record pace. There is still no major story for US or world grain markets, but downside risk below $3.40 basis December, is limited. US ethanol production last week totaled a near record 310 million gallons, up 10 million on the same week a year ago, and particularly high for late October. Ethanol stocks remain large, but current economics bode favourably for the biofuel. Gasoline stocks continue to erode, and the recent boost in US/world energy prices makes fundamental sense. The incentive to blend ethanol remains elevated, and record corn use is expected. FC Stone in its October report raised US corn yield to 173.7 bushels/acre, just 1 bu shy of last year’s record and which if realised will add 75-100 million bu to 2017/18 US corn end stocks. Consequently any meaningful tightening of the US balance sheet demands adverse S American weather, which is possible but won’t be a market factor until January. Both the bulls and the bears will continue to struggle in the meantime.

- Chicago wheat traded in just a 3 cent range, but ended the day steady to fractionally lower. Funds have built a sizeable short position, but at 100,000 contracts is still 60,000 shy of the 2016’s record. French milling wheat futures are nearing contract lows, and this along with weakness in the €uro have pulled European cash prices to levels at or below Russian origin. German offers for nearby delivery have fallen some $15/mt from highs posted in mid-summer. Competition for world demand remains stiff. Ongoing warmth in the Black Sea will sustain an elevated shipment pace in Russia, and any boost in the US’s share of world trade awaits the winter months. A shift to wetter weather in eastern Australia into late November is occurring at the wrong time, harvest is dead ahead, but otherwise rallies demand adverse S American weather this winter, or drought in the Black Sea next spring. Wheat lacks a story.