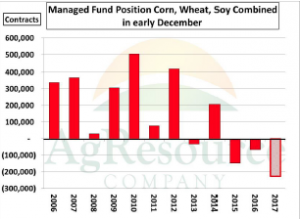

- Funds have been trimming net short position in grains, and adding modestly to their net long in soybeans. Still, the combined position is historically short, and we advise caution against turning bearish on breaks. A vast majority of the S American growing season is yet to come (recall Brazil’s drought in 2016 began in late January), and the short side of the market remains pretty crowded.

- Soybeans were higher overnight, but found selling right from the morning open that kept soybeans and meal down through most of the day. The break in meal offered support to the soyoil prices on meal/oil spreads. Commodity fund traders were estimated as net sellers of 5,000 soybean and 4,500 soymeal contracts, and bought 4,000 contracts in the soyoil market. The Commitment of Traders report confirmed that funds had added to their soybean position through last week. Funds were estimated as net long nearly 55,000 futures contracts and were net short 1,751 contracts in the options market. Hedgers used the rally to 5 month highs for sales, taking their hedged position (net short) to the most in 7 weeks. Hedgers were net short near 120,000 contracts vs. 245,000 a year ago. The USDA’s WASDE and the Brazilian crop report will be released on Tuesday, and are expected to feature slower US exports and a larger Brazilian crop. After the reports are released, S American weather will drive Chicago soy trading into early 2018.

- Corn futures today ended slightly higher, and largely shrugged off a much wetter Argentine pattern predicted by the GFS weather forecast at midday. Indeed, the EU model this afternoon failed to validate the GFS’s solution, particularly in C Argentina, and instead rainfall over the next 10 days will be rather scattered. Some rain will fall, but not enough to reverse the trend in soil moisture. Sunday night’s forecast is key, particularly as the models start to peek into the latter part of December. We maintain that any meaningful pattern shift there will be difficult over the next 30-45 days amid ongoing cool equatorial Pacific Ocean temperatures. Otherwise, the managed funds as of Tuesday were short a net 161,000 contracts in Chicago, a number roughly in line with expectations, if perhaps a bit smaller. Short term direction will upon whether heavy rain finally appears in Argentina’s 10-day forecast, and we note that 45-day precipitation across much of Argentina’s Corn Belt ranges from 40-60% of normal.

- US wheat futures find newer contract lows today, as the delivery period has proven rather bearish and as there is an otherwise lack of fresh news. Managed funds as of Tuesday were short a net 119,000 contracts, vs. 123,000 the prior week, and are likely short some 130,000 contracts today. Some kind of short-covering rally is expected before year’s end. EU wheat futures and cash prices attempted to rally slightly today, and so comparable Gulf HRW will be offered Monday at a $3-4/mt discount to German/Baltic origin, and surpluses in N Europe continue to dwindle. Domestic Russian prices remain stable, the US market has corrected sharply, and we fully expect Russian fob offers to stay at $190- 195/mt into early 2018, which is not bearish relative to current US futures prices. A needed demand driver is still absent, but amid funds’ short, developing drought across the Central US, and competitive Gulf prices a bearish stance is not advised.