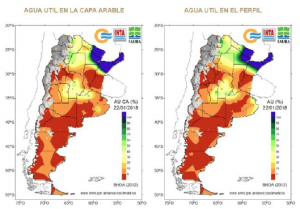

- The map (below) to the left is topsoil and the chart on the right is subsoil moisture as of today. The only location where there is plenty of soil moisture is far NE Argentina, where few crops are grown. The Argentine dryness stretches all the way back to October, and although there have been promises of drought ending soakers, the rains have all been localised. Much of Argentina is dry and the forecasts are arid into early February.

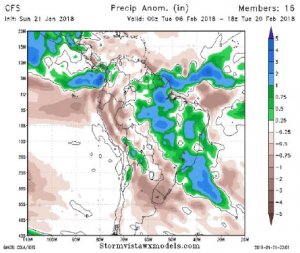

- Improved rainfall returns to Central Brazil by late week, but the CFS weather model in recent releases has trended noticeably drier across Argentina. Very little rain is forecast in the next two weeks, and the latest guidance on 16-30 day rainfall is below average. 56% of Argentina’s early planted crop is in the silking phase, and the need for rain is immediate. Unfortunately a major pattern change is unlikely between now and early February. Dryness and above normal temperatures will linger across Brazil through the balance of the week. Thereafter, a high pressure ridge wanes which allows normal tropical shower activity to resume in Mato Grosso, Goias and Minas Gerais. It is still important that this shift materialises as pockets of Central Brazil are starting to experience crop stress. In Argentina, no meaningful rain of note is offered to the primary ag belt into Feb 1, and the graphic below suggests La Niña based dryness likely continues to mid-February. Time is running out to salvage trend Argentine corn yield potential.

- The Argentine 2018 corn crop is going backwards, and rather quickly. One-off rain events since October have done little to curb the ongoing decline in soil moisture and without a major pattern change in the next 3-4 weeks, LLa Niña looks to negatively impact summer row crop production. Cumulative rains in Argentina since Dec 1 across the primary Corn Belt (Buenos Aires, Cordoba & Santa Fe) are just 60% of last year. Assuming the 7-day forecast is correct rainfall will exist at just 66% of normal and 58% of last year. Cumulative Dec-Jan rainfall of less than 8” is very often associated with La Niña establishment, and also indicates corn and soy yields well below trend. Such would appear to be the case in 2017/18.

- Dec-Jan cumulative rainfall correlates decently with final corn yield in Argentina. Typically it is December and February rainfall that most impact crop potential, but following this year’s delayed seeding, we suspect that the need for rain is immediate for both early and later planted crops. The Buenos Aires Grain Exchange last week reported that 45% of early planted corn is rated poor/very poor; 53% of later planted corn is poor/very poor. A majority of the crop will be in its silking phase by late month, and so the current dryness is indeed impacting yield. Using Dec-Jan precipitation to date, work indicates a final Argentine corn yield 15- 18% below trend. Though the model isn’t perfect, it is clear that rainfall of 10” plus is needed for corn yield to reach trend or above. Precipitation of 5” in Feb would be helpful, but the forecast models want to maintain the arid trend.

- What is important about the lack of rainfall in January is that the production loss is beginning to cross the threshold where it does impact the global corn trade matrix. Assuming an Argentine corn yield 15% below trend (6.75 mt/ha), production comes in at 33.8 million mt. Even with record large carryin stocks such production will allow for an exportable surplus of just 24-25 million mt, vs. actual exports of 25 million mt last year and the USDA’s forecast for the coming year of 29 million mt, thus 185 million bu will be switched to other origins. Given the recent surge in Black Sea corn basis, and the uncertainty over safrinha production in Brazil, the US will be the primary beneficiary. There is no shortage of corn in the world, but as the market begins to question US acreage in 2018, We seriously doubt that spot futures can fall much farther. Argentine losses may well spark fund covering.

- It was a higher start to the week as the trade resumed concern for the Argentine crop. Old crop soymeal led the day’s rally and and finished up $7/ton. Funds were estimated buyers through the day of 7,000 soybean and 6,000 soymeal contracts while selling 1,000 soyoil. Soy markets appear largely focused on Argentine weather and the potential impact on crop size/meal exports. Soyoil was thought to be the story of the year on expanding biofuel demand, but is marking new lows this week and down 9% for the year, while soymeal has marked new highs and is up 15%. The largest notable change has been in the spot soybean crush spread which has now gained 25% from the start of the year and 52% over the September low. Chicago is offering processors an average margins of $1.11/bu to the end of the year versus $.83 last year and the 5 year average of $.68. Limited rains look to fall across Argentina over the next two weeks. Our next target for March beans is at $10.10. Remember that funds are short close to 90,000 contract of soybeans.

- March corn moved very little, and aside from ongoing dryness in Argentina, fresh news was absent. However, We view the coming weather pattern in Argentina and far S Brazil as highly important, as now production losses look to shift export demand in 2018 to other origins. This along with uncertainty over US corn seeding this spring, and as US domestic corn use has ballooned to a record 12.5 billion bu, will keep spot futures well supported above $3.45. Funds sold a net 5,000 contracts today, and thus maintain a short position worth 215-217,000 contracts. Argentine dryness is priority number one, but in the meantime the market continues to work to boost overall consumption. Brazilian ethanol’s premium to US origin has widened further to $.92/gallon (40%), and ongoing ethanol exports are attracting market attention. Gulf corn is offered below all other origins through May. A close above $3.55, March, is needed to attract fund short covering.

- Wheat futures continue to recover post-USDA report losses, albeit very slowly. However, the lack of any demand driver is working to limit any meaningful fund short covering. World cash fob offers are moving higher, but not at the speed of those in the US, and so Gulf HRW is again positioned rather poorly in the world market. Export sales in the next 1-2 weeks will stay uneventful. However, the downside risk is lacking. The market’s goal in the coming weeks and months is to reconcile weak export demand with low winter wheat area as well as an expanding Plains drought. Still no meaningful precipitation is included in the Plains’ 2- week forecast, and climate guidance maintains ongoing below normal precipitation into April. This is mostly a function of the duration of La Niña. More pronounced short covering requires adverse weather in one more major exporting country; Russia, the EU or the Ukraine.