- Cash and Chicago soybean crush margins have reached their best levels in nearly two years. Soymeal end users around the world are caught with limited forward coverage as Argentina is within the throes of a developing drought. Rain is badly needed and the forecasts are not offering a change in the arid weather pattern into mid- February. As long as US and world soymeal values rise, firming crush margins are forecast. We note that the Brazilian soybean crop could rise to 112-113 million mt, but this will not be enough to offset the Argentine losses. Fund managers are taking note.

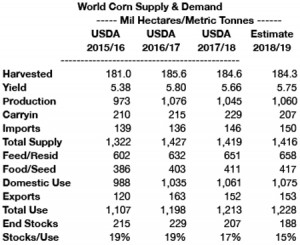

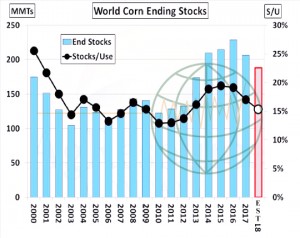

- World corn acreage surged from 2009 to 2013, which was a function of price/profit. More acres were added in 2016, which was a function of non-US dollar currencies. However, as producer balance sheets change via Chicago prices and relative strength, even mild demand growth looks to cut world corn ending stocks. We fully expect corn seeding to expand another 1 million ha in Argentina in 2018, but decline in Russia, the US and China. The net is a slight reduction in total world corn area. Assuming trend yield and trend (and even somewhat weak) consumption growth, using acreage of 184.3 million ha results in a 19 million mt (9%) decline in global corn stocks. Note that world animal numbers are expanding following contraction in 2015 and 2016, world meat consumption growth is accelerating, and Chinese meat consumption is rising for the first time since 2014.

- Global corn stocks/use at 15% will be the lowest since 2012, and while not overly bullish, it does suggest fair value in the next 12 months lies between $3.40-3.85 basis spot Chicago. Of course, a US yield of 176-180 bushels/acre would alter this outlook, but the most probable scenario features trend yield in the US and elsewhere. Importantly, following five years of depressed prices, the market has worked to elevate consumption, making weather issues a bit more interesting in 2018/19. Moreover, China has signalled it plans to embark on a comprehensive biofuel program and biofuels in general will be attractive until world crude producers respond with higher production. We maintain a broadly neutral corn outlook, but wishes to point out that the recent bear market has likely run its course. In recent years adverse weather was needed for rallies; in coming years very good weather is needed for a further break.

- Soy prices finished higher on Tuesday, with soyoil following palm oil prices higher, but also pacing the day’s advance in Chicago. The palm oil market found demand on Tuesday from deeply oversold conditions and slow production figures for the first half of January. Commodity funds traders were estimated buyers of 3,000 soybean contracts, and 4,000 contracts each in the soymeal and soyoil markets. After declining for three weeks, estimated Chinese soybean crush rates turned up last week to a 3 week high of 1.9 million mt. The current pace remains record large, however, soymeal stocks have also been moving higher since mid-November. There is a loose (and inverse) relationship between soymeal stocks and estimated crush margins. However, there is no statistical relationship between estimated margins and Chinese imports, and based on US and S American export to China in December, we expect that January imports will be at or near a record large figure of 6-7 million mt. The big event for Wednesday will be the trial of former Brazilian president Lula, and the impact that the results have on the Brazilian Real. Elsewhere in S America, Argentine crops have very little rain in the forecast.

- March corn fell slightly, and still appears bound to a range of $3.45-3.55 in the near term. We continue to caution against turning bearish at the lower end of this range amid ongoing, and accelerating, dryness in Argentina and as the US$ forged new lows for its recent move. US weekly export sales through the balance of winter should also be well above the pace needed to meet the USDA’s forecast. Without perfect weather, the most probable scenario includes further cuts to global stocks amid a lack of acreage expansion. The market in recent years has very slowly worked to build a rather sizeable demand pillar, and so work continues to suggest that multi-year lows were posted in 2016. Notice that ethanol’s discount to gasoline is testing the levels established during Hurricane Harvey. The EIA’s weekly ethanol report on Wednesday should be supportive. Funds have done little to change their massive net short position.

- Better than expected snow fell across N KS and NE in the last 24 hours, but, such totals will do little to curb drought expansion. Work suggests there is adequate snow cover given no extreme cold is expected across TX & OK in the next two weeks. Choppy trade will continue, and breaks look to be supported amid weakness in the US$, firm world cash markets and as funds maintain a net short position in Chicago worth 140,000 contracts. US wheat futures since early autumn have struggled at major moving averages, and the market awaits pronounced weather adversity or a demand driver to trade above $4.40, basis spot Chicago. This is logical as Black Sea stocks and export remain elevated. However, unlike recent years, major exporter currencies are strengthening, which is working to support world cash prices, Russian fob offers today sit at a season-high $194/mt, and still the market must reconcile widespread drought in the US, which according to climate work isn’t going away through the balance of winter.