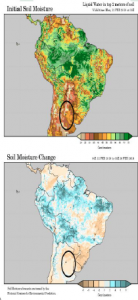

- Rains failed to appear as forecast in Argentina over the weekend, and very little rain is offered to Argentina’s primary Ag Belt over the next ten days. Like in the US Plains, it is unlikely that this pattern of stagnant heat/dryness changes until La Niña fades, and a vast majority of Argentina’s crops will reach critical growing stages in the next few weeks. Work suggests Argentina’s corn/soy yield losses are reaching critical stages, and, importantly, are more than offsetting production gains in Brazil. The GFS weather model’s projected seven-day change in soil moisture is below, and the issue ahead is the lack of any potential rainfall into late February. The major forecasting models hint at better rain chances beyond the next 8-10 days, but so far this winter the extended range forecast has failed to perform. Note that steep yield loss (10-30% below trend) are common during La Niña years, and our concern is that Argentine corn and bean production will be below current trade estimates. Brazilian conditions are fine, but S American production as a whole is concerning.

- The Central US forecast maintains an easterly bias to meaningful precipitation through the end of February, and so drought across the Plains looks to expand through end of the month. Until La Niña fades (perhaps in late spring) we doubt a pattern change will occur, and additional weather premium will be added should extreme drought persist across the Western US in Mar/Apr, which is likely. The outlook for the W Plains has trended a bit drier in recent days. A slightly southward mean position of the Polar Vortex will sustain cool/dry conditions across all but the far E Midwest and mid-South over the next ten days, which has been a stagnant pattern since early winter. Longer term climate outlooks lack any pattern change through March 5, and we monitor US soil moisture closely as spring approaches. Recall an El Niño/La Niña-like climate has been in place since late 2014, and so the coming year will be more volatile in terms of weather.

- Soy futures rallied to strong gains at the start of the week as concerns for Argentine crops accelerates. Soymeal led Monday’s rally, gapping higher overnight and breaking out of a longer term consolidation pattern to mark the highest close since July 2016. Soybeans followed along and rallied 18-19 cents, but did not keep up with the meal rally, which put nearby crush spreads up more than $.10. Funds were estimated buyers of 17,000 soybean and 13,000 soymeal contracts through the day. Based on Monday’s buying, we estimate that funds are now very close to flat in soybeans and long 75-80,000 contracts in soymeal. Soybean export inspections again ticked higher to 48.5 million bu for last week, while the cumulative total holds nearly 206 million bu behind a year ago. The USDA also announced that China cancelled close to 0.5 million mt of old crop export sales, though much of that cancellation was offset by sales announcements to unknown destinations. The Argentine forecast stays dry over the next 5 days, while the EU forecast shows far less rain than the GFS in the 6-10 outlook. Our view stays bullish as Arg crops roll back.

- The lack of rain in Argentina over the weekend, as well as continued dryness there over the next 10 days, triggered additional short covering to start the week. The Argentine corn crop is trouble, but also more attention is being paid to potential dryness across the US this summer amid a lingering La Niña. Fund shorts are being liquidated. Following several years of above-trend US corn yields, being short during S America’s growing season, and ahead of US seedings, is coming under increased scrutiny. US Gulf corn is still the cheapest feedgrain in the world, which is perhaps the most important fundamental, and while a global demand spark is lacking there just hasn’t been any bearish input in recent weeks. By any measure spot Chicago futures at $3.65 are still cheap, and so end users are advised to extend supply coverage on modest breaks. Downside risk is limited unless/until US soil moisture improves.

- World grain futures ended higher amid ongoing dryness in Argentina, and US wheat futures continue to add premium based on the lack of any precipitation offered to the US HRW Belt. The current drought is rather structural in nature, and as we have mentioned before until La Niña fades it’s unlikely that precipitation of note will be established across the Southern and Western Plains. While there’s some disagreement regarding La Niña this summer it’s likely that the phenomenon persists throughout the heart of the US winter wheat growing stage. Though it’s only winter, a sharply reduced HRW yield is becoming increasingly likely. The global macro environment is also relatively favourable compared to recent years. The US$ today was little changed, and unlike a year ago there’s not nearly as much incentive offered to other world exporters to continue to expand seedings. As such, the potential loss of US supply will affect major exporter stock/use more, and in turn the fair value of world world wheat is being raised.