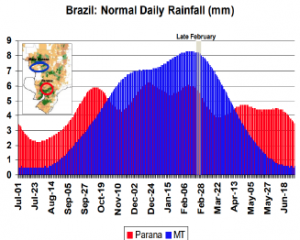

- In Brazil, rainfall totals seasonally peak in late February across Mato Grosso, while totals for Parana and areas farther south continue into June. The winter corn crop across N Brazil depends on an extended rainy season that lasts into May. Notice from the graphic below that rain totals progressively decline, but don’t reach arid levels until late April. Current wetness is aiding the outlook for winter corn yields across N Brazil. An estimated 20-25% of the crop could be seeded late, but that won’t become important unless the wet season ends prematurely.

- Egypt’s General Authority for Supply Commodities (GASC) purchased 175,000 mt of Russian wheat at average price of $230.70/mt basis C&F . 13 out of the last 15 tenders have been filled by exclusively Russian wheat. Prices reached new highs for the season but Russia continues to dominate Egyptian business.

- Tuesday was a mostly lower day of trade in Chicago soybean and meal markets, while soyoil prices were higher at day’s end. The USDA announced that China bought two more cargos of old crop US soybeans, and Tuesday’s sale marks the fifth export sales announcement in the last five days. In total, soybean export sales announcements have amounted to just over 1 million mt since last Monday, with all but 123,000 mt of that total being old crop sales. More than half of the old crop total is known to be to China, and the rest is to an unknown destination. Soymeal spreads have seen profit taking ahead of the March WASDE, which also left old crop/new crop soybean prices mixed at the end of Tuesday. The nearby soybean crush spread, which closed at $1.50/bu last week and was at $1.37/bu at todays close. Some of the driest parts of Buenos Aires are expected to see better rains in late March. However forecast rains are far from being a drought buster, and confidence in the outlook beyond ten days is often (rightly) low. We expect corrections just ahead or just after Thursday’s WASDE report will be well supported. CONAB will be out Thursday morning with their latest Brazil forecast.

- May corn settled at new rally highs and, unlike wheat, corn is finding demand at current prices rather than rationing it. Gulf basis has rallied along with the pace of export sales, but Black Sea feed wheat has found new highs. Regardless of final S American production estimates, exports won’t begin there until June. Weekly ethanol production is due Wednesday and export sales on Thursday will exceed the pace needed to meet the USDA by 3-4 times the needed weekly average. US ethanol blend margins have recovered February’s loss and this evening sit at a lofty $.04/gallon (vs. $.01 a year ago). US ethanol stocks have been contracting slowly since mid-January, and amid elevated incentive to blend/export supply a further contraction in stocks lies ahead. Brazilian cash ethanol prices remain lofty and at a sizeable premium to US origin to facilitate imports. We maintain that future gains will be more difficult, but that the rally is supported by record US export sales since Jan 1 (and to some extent higher domestic use). We see the nearby upside price target basis May is $3.90-3.95.

- It remains that downside risk in wheat is limited until/unless widespread rainfall materialises across the US Western Plains. However, there’s evidence to suggest La Niña’s end is imminent, which should bode favourbaly for Plains rain this spring. Additionally, the US market is working to slow old and new crop export demand, and is also hindering summer feed consumption via it’s relationship with corn. Recall that feed/residual use in the Jun-Aug quarter last year was a 35-year low 170 million bu. Russia’s cash market is firm this afternoon following another sizeable Egyptian purchase. Even at multi-year highs, the Russian market is buying sizeable demand, and seasonal trends don’t usually turn noticeably weaker in the Black Sea until spring. US Gulf wheat is offered roughly $1/bu over comparable Black Sea/EU origins, and the risk is that weather premium will be extracted within a matter of days should the Central US pattern change in the next 3-4 weeks. A close eye will need to be kept on 16-30 day forecast as those models begin to digest a warming of the equatorial Pacific. The seasonal trend for rain increases in April across the W Plains. The world still has an abundance of wheat and another record crop is possible in 2018.