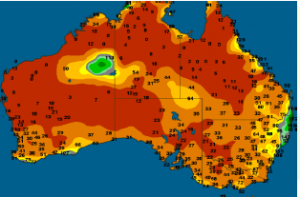

- Spring has arrived in Australia, but to big disappointment not much if any rain. The map reflects rainfall as a percent of normal during the usually wettest month of the year, September. Broad areas of Australia are enduring the second year of dire drought which has rallied feed wheat prices to $8-11/bu. Unless rain falls during October, livestock producers will have no choice but to cull herds and pay extremely high feed prices to maintain a breeding herd. It’s becoming dire for the entire Aussie ag sector.

- Limited news and the fresh announcement of additional US tariffs on imported Chinese goods weighed on Chicago soy trade. US cash markets remain weak in a mix of large crops and the lack of Chinese demand. The carry from Nov to Jul widened to $.5075/bu as Chicago attempts to get farmers to store as much of their crop as possible. Soyoil led the soy complex lower as Asian palm oil markets fell sharply. Argentine soyoil exports have remained slow through the late summer, and by month end the cumulative total will likely be the slowest pace since 2002. The problem for world vegoil markets is large Indian import taxes that have slowed palm oil and other vegoil imports. This continues to pressure world prices. Malaysian palm oil futures fell to an 8 week low overnight, and the 2% drop pulled Chicago soyoil to similar losses. Big crops and the lack of China demand continues to pull soy prices lower. But with cash basis at historic low levels and Chicago spreads at full carry, we expect farmers will opt to store as much of the new crop harvest as possible. November futures are testing key support at $8.10, and it could take big S American crops before November falls below $7.80.

- Dec corn fell to new lows as President Trump opted to activate 10% tariffs on $200 billion bu worth of Chinese goods. Because of the ongoing US-China tariff battle, Informa this pegged 2019/20 US corn acres at 93 million. Assuming trend yield and consumption, record consumption can be absorbed assuming normal weather in other major exporting countries next year. Funds sold 7,600 corn contracts on Tuesday. Argentine fob corn basis has stabilised, and otherwise, Gulf corn is cheap relative to all other feed grains. Note that EU corn futures have been unchanged for three consecutive weeks, and rest at a lofty $70/mt ($1.80/bu) premium to Chicago futures. Even Ukraine feed wheat, which is reportedly abundant, is trading $20/mt above last year and $40 above US corn. Funds are estimated to be net short 140,000 contracts in Chicago. The market is deeply oversold. We can not become bearish ahead of harvest, and as combine reports need to be both consistent and record large. Corn is fundamentally undervalued, spot corn is down $.08/bu from a year ago. Further downside risk is political in nature, and doubtful below $3.40 basis December futures.

- US and world wheat futures ended modestly higher. World cash markets followed. Most importantly Egypt bought 375,000 mt of wheat at an average fob price of $228/mt. This is up $5/mt from its tender last week and compares to $197 in Sept of last year. All but one cargo was sourced from Russia. Turkey has released a tender for 253,000 mt of milling wheat, which closes next Tuesday. World demand is solid. The pace of Russian exports aside, quality issues are at the forefront of the Black Sea market. Quality will be monitored acutely by the Russia Government moving forward. Recall a much larger percentage of Ukraine’s crop is feed. Australian frost/freeze this week has been documented, but more significant is a trend of complete dryness, which likely persists into October. The 10-day forecast is void of rainfall. Wheat should continue to trade independently from row crop trade issues. Major exporter production will fall amid ongoing weather adversity in Australia. Net fund length in Chicago has been liquidated. The market has also recovered only modestly from nearing oversold technical levels last week. We continue to favour a bullish wheat outlook.