- Friday’s eagerly awaited USDA report left us with one clear message, and that is: “there is insufficient feed stock in the world right now”. How about that for a headline?

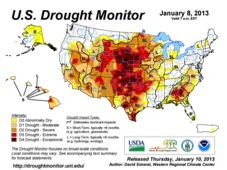

- US corn stocks, as of 1 December, fell to 8,030 million bu, down from 9,747 million bu at the same time last year. Demand rationing, through price hikes, is essential if minimum pipeline supplies are to be in place at the end of the season. The detail of the report included reference to forage stocks within the US being at record low levels (basis 1 December) due to the drought and depleted soil moisture levels in the Plains. With this in mind, feed demand for corn is likely to remain pressured until springtime and possibly longer if adequate rains and snow melt do not materialise.

- Harvested acres were reduced, as expected, but this was offset by another yield improvement; however, domestic feed and residual usage was reported as the highest since 2007, clear evidence that despite high cash basis prices we have seen little in the way of rationing to date. Corn exports from the US were forecast lower which we struggle with given latent demand from other regions including the EU (which was left unchanged) and S American exports were raised by 2.5 million mt to which we raised an eyebrow given weather conditions in Argentina.

- For corn, it is abundantly clear that the world is wholly reliant upon massive US plantings this year, and for those plantings to materialise into a massive crop. Given the soil moisture deficit from last year’s drought, which is still persisting in some areas, the desired outcome is far from a foregone conclusion. We look for prices to escalate into the remainder of the coming season.

- Wheat figures were more of a non-event aside from a slight reduction in US feed and end stocks (38 million bu), the main event being winter wheat acres less than trade expectations with hard red wheat some 1.2 million acres lower than average expectation although soft red was around half a million acres more than expected. Given (once again) the Plains drought and soil moisture deficit, the potential for abandonment is high and the potential for an incredibly tight US (and hence global) supply and demand picture is very real. The pace of US exports to date has been slow, but this picture is changing right now and we would expect to see a swift recovery in these numbers as long as US pricing remains were it is now in relation to its competitors – cheap!

- Soybean data saw an increase in both acres and yield as expected, giving a further 44 million bu to the supply side, but US exports were left unchanged much to our surprise. Overall, our impression is that the bad news is yet to come in beans. The potential overstatement of crop and understatement of exports points to extremely tight ending stocks, possibly below pipeline requirements. The implication being that higher prices will be required to force rationing, either of domestic crush, or exports, to permit sufficient year end stock for the US to keep working.

- Meanwhile, aside from the USDA’s report, the “normal working week” provided us with the following:

- US weekly exports continue to be disappointing in wheat and corn although Thursday’s Egyptian tender convincingly highlighted the competitive nature of US wheat. The US picked up 55,000 mt of soft red winter wheat business with Canada securing 60,000 mt. To further illustrate the point, the C&F prices attributed to the deal would appear to be lower than the French FOB levels! The competitive pricing potentially paves the way for a pick-up in export pace for US wheat from now on, as there are few offers around from the usual exporters.

- Soybean export numbers remain strong with China leading the way as buyers as their current crush margins are historically large. The Chinese crushers traditionally “lock in” such margins whilst they are available and this has led to their recent buying spree, which has seen them taking good cover through to Feb and March. We expect US stock forecasts to remain extremely tight, unless price hikes force the necessary demand rationing.

This week, US Agriculture Secretary Tom Vilsack designating 597 counties and 14 states as “primary natural disaster areas due to drought and heat.” The impact of this designation is to make farmers in these areas eligible for emergency loans at low interest rates. Last year some 2,245 counties and 39 states (71% of the US) qualified for this same status.

This week, US Agriculture Secretary Tom Vilsack designating 597 counties and 14 states as “primary natural disaster areas due to drought and heat.” The impact of this designation is to make farmers in these areas eligible for emergency loans at low interest rates. Last year some 2,245 counties and 39 states (71% of the US) qualified for this same status.- The dry and unseasonably mild conditions persist leaving in question as much as 25% of the US wheat crop which may be subject to abandonment in the springtime. The choice of replacement cropping will be very much a reflection on the overwinter conditions and spring weather but we would consider it unlikely that significant acres were replaced with wheat. This would leave US wheat output for 2013 behind 2012 in a year when global supplies are far from bursting out of the barn.

- Australian weather conditions in key wheat growing states have been dry and hot to say the least. The intense drought and extreme heat of the last three months has worsened the outlook for the 2012/13 harvest. Current temperatures have topped 44 to 45℃ (112 to 114℉) in parts of New South Wales and South Australia (key wheat growing regions) and follow an intensely hot December. To put these temperatures into context, they are 8℃ (14℉) above normal. However, all is not lost. Western Australia received later and significant rainfall, which followed a dry beginning to the season, leading to a “reasonable” crop. Additionally, the region has not suffered the same intensity of heat as SA and NSW. There are, however, potential quality issues with late harvested grains sprouting due to wet harvest conditions. The dryer eastern regions have the potential to suffer from shriveled grains as a direct result of heat, which will compromise overall yield. All in all, the USDA’s 22 million mt estimate for Australian wheat output looks to be a high number right now, an output of closer to 20 million mt appears more likely in the light of the conditions.

- In summary, the USDA numbers and pretty much everything else we see in the world right now is pointing towards tightness and ultimately higher numbers.

International Agri Trading Ltd

Trading, Analysis, Consultancy