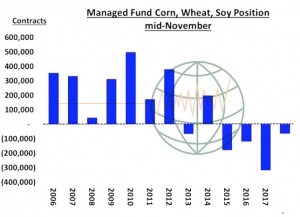

- Funds are net short a combined 63,728 contracts of corn, soybeans and Chicago wheat. This position makes sense amid lingering barriers to Chinese imports. The fundamental outlook favours grains over soy into the spring of 2019, but we do expect this net fund position to get to flat (as we have frequently suggested) rather quickly should US-China trade dialogue be positive later this year.

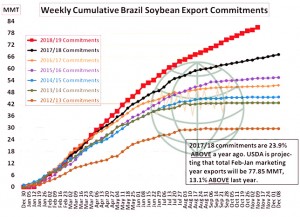

- Jan soybean futures had their highest close in almost a month. The market has rallied on rising optimism that China and the US might resolve their trade dispute. But, even if talks are successful, nobody is projecting a resolution until sometime after January. By then, Brazil will be exporting its record soybean crop. It is unlikely that US exports will see much of a benefit until next autumn. The USDA raised Brazil’s old-crop soybeans by 3 million mt in its November WASDE. However, the Brazilian crushers association ABIOVE pegged exports at 79 million mt. ABIOVE uses a slightly different local marketing year (Jan-Dec) vs USDA’s Feb-Jan but the implication is that USDA’s projection is perhaps 2-3 million mt too low. One Brazilian grain merchant went so far as to project exports of 83 million mt. As of Nov 9, ship lineups indicated that Brazil’s export “commitments” were 81 million mt. That is 15.7 million or 24% above a year ago. USDA is projecting exports will rise just 13%. Without a US-Sino trade agreement, futures are at risk of falling to $8.00 or below.

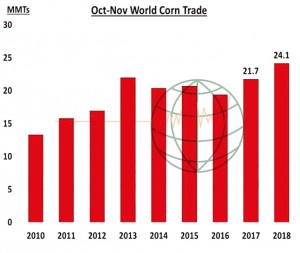

- Dec corn fell 3 cents amid competing crosscurrents. Concern over the pace of global economic growth continues. Crude ended flat. World cash basis levels are up on the week but unchanged on the day, and competition with Ukraine into Asia will be ongoing in the months ahead. Funds on Tuesday were long a net 18,000 contracts, vs. 27,000 the previous week. Funds today are estimated to be short closer to even. US weekly export sales totaled a decent 35 million bu, up 8 million on the week and right at the pace needed to hit the USDA’s target. Competition for market share is noted, but our supportive thesis centres on world trade as a whole. Using ship lineups, we estimate Oct-Nov combined world corn trade at a record 24.1 million mt. Expensive feed/milling wheat and barley will keep global corn demand strong. There is enough interest to put both US and Ukrainian exports at record levels. The next potentially market-moving event will be the G20 meeting, which begins on Nov 30. Thereafter, it is S American weather. A lasting period of dryness is needed in Argentina, while a drier overall pattern is desired in Brazil. Of note also is that Dec oat futures rallied 6 cents and are once again flirting with $3.00.

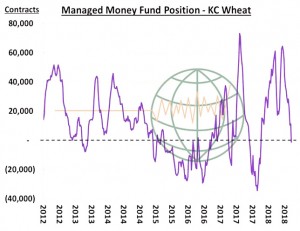

- US wheat futures ended steady to higher with KC gaining on other classes. As expected, managed funds were net short (1,000 contracts) in KC on Tuesday, and this evening are estimated to be short closer to 5-6,000 contracts. It has taken nine months, but length in KC has been fully liquidated. A more supportive trend is expected moving forward as major importers begin to seek high-protein coverage for 2019. The US is well positioned to boost market share. There are no details surrounding Saudi Arabia’s tender for 475,000 mt. But also recall Iraq will be in the market on the weekend. Egypt’s last tender was for late Dec shipment, and so we expect Egypt to return shortly. Russian interior prices are higher in US$ terms this week. Replacement value is pegged at $170/mt, and when adding taxes exporter margins remain thin. Seasonal trends in world cash prices are higher through the winter months. We maintain a longer term bullish outlook. Note that any build in new crop exporter stocks require widespread favourable weather next spring/summer.

To download our weekly update as a PDF file please click on the link below:

Weekend summary 16 November 2018

Our weekly fund position charts can be downloaded by clicking on the link below:

Fund positions disaggregated data