- Looking back over the last week leaves us with one overriding thought, and that is that it has been uninspiring one to say the least!

- Probably the biggest news item, that turned out to be a non-item in the end, was talk of Russia lifting their 5% grain import duty in an effort to relieve the seemingly never-ending upward momentum in their domestic wheat and flour prices. The news was denied in quick time and markets gave back the gains made, and more, but the speed with which intervention grain sales are snapped up, despite hefty transport costs, and rumoured wheat sales into St Petersburg do tend to point in one direction. It would appear that the much-reported 2 million mt wheat import requirement to bolster the season is not a million miles away from the truth.

- In a similar vein the on-going EU situation perhaps warrants closer inspection. This week, Brussels issued wheat export licences for 390,000 mt bringing the season to date total to 12.032 million mt, this compares with 9.749 million mt at the same time last year. The increase, 2.283 million mt, or 23.4%, when considered in the light of what else is available to compete can only be viewed as huge. The lack of Black Sea supplies as well as steady EU wheat demand would make the USDA’s latest projections on EU end stocks look far too tight. Their projection left the EU with some 24 days of stock, and we are significantly ahead of their export pace at this time.

- The conclusion we draw therefore depends upon what happens in terms of exports moving forward. Maintaining the current pace of exports will reduce already uncomfortably tight end stocks, which will most likely need to be bolstered by feed grain imports to ensure adequacy of supply. A reduction in export pace would seem to be on the cards given the $25 to $30 per tonne discount which US wheat has over French at the moment, and Australian wheat is also competitive; the question remains though, will the reduced pace be sufficient?

- There is evidence, in the UK at least, of some significant corn purchasing by consumers at prices below wheat levels adding some support to the argument above.

- In the news, Ukraine domestic usage of corn seems to be smaller which should increase their potential supply to be exported, largely to the EU.

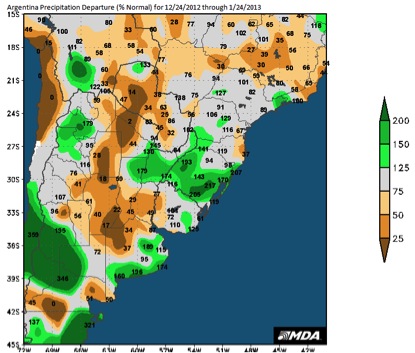

The other “elephant in the room” continues to be the S American weather which is giving rise to some concerns, in particular over fast drying Argentine topsoil levels, which would appear to be creating some stress levels in late planted and shallow rooted corn crops. This seems somewhat incongruous following the prolonged period of extreme wet weather endured by the region. However, it was the wet weather that delayed planting and has created the late crop and subsequent lack of root penetration, which would be evident under more normal climatic conditions.

The other “elephant in the room” continues to be the S American weather which is giving rise to some concerns, in particular over fast drying Argentine topsoil levels, which would appear to be creating some stress levels in late planted and shallow rooted corn crops. This seems somewhat incongruous following the prolonged period of extreme wet weather endured by the region. However, it was the wet weather that delayed planting and has created the late crop and subsequent lack of root penetration, which would be evident under more normal climatic conditions.- In other news we continue to see extremely dry conditions in the US Mid West and Plains, which is impacting wheat crops and, unless we see significant replenishing precipitation (which appears unlikely right now) the prospects of a second consecutive dry season look to be on the cards. In addition the deep insulating snow layer has thawed leaving soils open to -21°C to -24°C (-7°F to -12°F) temperatures and deep penetrating frost which may well result in delayed spring plantings as more time will be required to allow the ground to warm up sufficiently.

International Agri Trading Ltd

Trading, Analysis, Consultancy