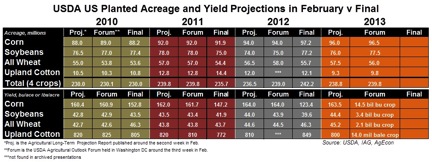

- The USDA’s Agricultural Outlook Forum has released its acreage and yield projections for 2013 harvest, the summary of which follows:

- Clearly the Forum is taking a bullish view on corn and soybean acres at the expense of wheat when compared with initial projections which we recently commented upon. However, overall Forum acres are over 2 million below last seasons final figure.

- Interestingly, the season price projections leave corn at an average figure of $4.80/bu, soybeans at $10.50 and wheat $7.00. It must be borne in mind that these numbers are for NEW crop and we still have some old crop mountains to climb yet.

- China is believed to have been the buyer of todays “unknown destination” sales of 130,450 mt US soybeans (of which 75,450 was old crop), and 110,000 mt US wheat (55,000 old crop). The wheat numbers have been taken by the market as bearish; CBOT wheat is hovering at $0.15/0.20 down as we write this.

- The IGC (International Grains Council) have left their estimate of world 2012/13 wheat production unchanged at 656 million mt, whilst elevating 2013/14 output some 4% with stocks building around 2 million mt. Their estimate of world corn output for 2012/13 is increased mom by 5 million mt to 850 million mt.

- US weather reports indicate some heavy snowfalls across the hard red wheat growing regions which could add a potential of up to one inch of moisture. Overall moisture deficit is being eroded, but slowly and more precipitation is required if springtime soil and subsoil moisture levels are to get close to normal. It is believed that a weakening La Niña effect is the cause of improved US rains, if this effect persists it is likely that more generous precipitation will help to relieve the persistent dry conditions.

- Brussels issued another 627,000 mt of wheat export licences this week with the season total now at 14.099 million mt, compared with 10.695 million mt this time last year. The increased 3.404 million mt represents an increase of 31.8% year on year; being repetitious yet again, we struggle to see how this can end well for everyone. Projected season ending stocks will be further depleted to below three weeks usage, remember last year’s rain delayed harvest, how could the EU cope with another rain delayed harvest if it were to occur? The impact on price would be something our grandchildren would talk about we suspect! How this translates into a $0.20/bu price decline in Chicago also causes us to raise an eyebrow once again.