- This week has seen a post USDA report and Easter break return to work in something of a mood of acceptance of the inevitable. Bigger stocks and a “nothing to worry about” attitude seem to prevail with the markets all at lower levels than they have been in recent weeks. Perhaps wheat has shown the most resilience with London and Paris markets virtually unchanged on pre report levels as opposed to the US corn market, which has fallen a full $1.00 per bushel and has shown little in the way of returning to former levels. The US soybean market took less of a hit, falling about $0.60 per bushel on Thursday but working another $0.30 per bushel lower over the course of this week.

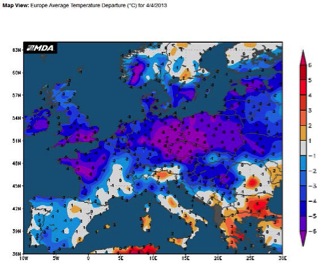

Going forward it would seem that the key influencing issue is that of weather. In Europe we are looking at the potential for a later, rather than earlier, harvest due to the prolonged period of cold weather. This has left soils colder than normal, which delays germination and emergence of spring sown crops as well as delaying crops coming out of winter dormancy. Anecdotal evidence within the UK this week is that growers and merchants are pricing wheat for August delivery in the north as a full old crop month. This is leaving new crop barley looking particularly attractive for August at substantial discounts. September barley also looks attractive but not quite the same “bargain” as August.

Going forward it would seem that the key influencing issue is that of weather. In Europe we are looking at the potential for a later, rather than earlier, harvest due to the prolonged period of cold weather. This has left soils colder than normal, which delays germination and emergence of spring sown crops as well as delaying crops coming out of winter dormancy. Anecdotal evidence within the UK this week is that growers and merchants are pricing wheat for August delivery in the north as a full old crop month. This is leaving new crop barley looking particularly attractive for August at substantial discounts. September barley also looks attractive but not quite the same “bargain” as August.

- Still on the subject of weather, the US is reported to remain cold throughout the first half of April with freezing temperatures remaining in place across the northern Plains and into Canada. As with Europe, the potential for planting delays exists, and many growers will be more than fully aware that any significant delay in corn planting will increase the possibility of any number of weather related issues down the line. Pollination at times of high temperature and peak crop moisture demand in high summer could well conspire to persuade some to switch acres away from corn to soybeans. We will be watching for tell-tale signs as plantings progress in coming weeks.

- Reports of a new strain of avian influenza in China (H7N9), transmissible to humans and possibly responsible for a number of deaths have hit the headlines this week. The World Health Organisation has played down fears of a global pandemic, similar to the H5N1 swine flu outbreak in 2009. However, this has not prevented Chinese traders from selling out soybean meal positions “just in case”, and creating a mood of lower pricing, particularly on the Dalian Exchange.

- Brussels have once again issued wheat export licences in excess of half a million mt, this week’s volume hitting 533,289 mt, which brings the season total to 17,201,767 mt. This is 4.556 million mt ahead of last year, a greater than 36% increase. Our “usual comments” apply!

- We continue to watch the balance of the old crop season unfold, specifically in relation to EU feed grains and how tight they may become. In addition, Russia and Ukraine’s attitudes and government policies as far as early season exports are concerned. This is in the light of last year’s large early season sales amid the context of poor harvests leaving tight ending stocks. No doubt this will be of keen interest to Egypt who seem to be holding back from further tenders amid statements to the effect that they have 80 or so days of stocks; cynically (as ever) we believe they may well be hard pressed for government foreign exchange reserves to back up tenders, as well a reluctance to accept IMF assistance for fear of austerity implications.

- No doubt the onset of milder spring weather conditions across the northern hemisphere will alleviate some of the concerns, but there is a long way to go before we see the potentially bumper harvests hit the barn floor and market pressures relieved.