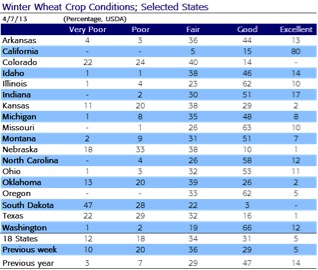

Seemingly we have an improving situation in US winter wheat condition with 36% rated good/excellent, which is a 2% improvement wow, but significantly behind last year’s 61%. Poor/very poor ratings stand unchanged wow at 30%, again a significant variation from last year’s 10%. Further detail is listed in the attached table.

Seemingly we have an improving situation in US winter wheat condition with 36% rated good/excellent, which is a 2% improvement wow, but significantly behind last year’s 61%. Poor/very poor ratings stand unchanged wow at 30%, again a significant variation from last year’s 10%. Further detail is listed in the attached table.

- Brazil’s Conab has released its latest output estimates with the 2012/13 soybean crop at 81.9 million mt (down 0.24% mom), and corn is estimated at 77.45 million mt, which is an increase from 76.1 million mt mom. Both numbers, if realised, would be record harvests!

- Closer to home, AgroConsult report lower Ukraine output forecasts as a consequence of the extended winter period. 2013 wheat output is seen at 20.23 million mt, down from 21.07 million mt mom; barley is seen at 7.75 million mt, again a reduction from last month’s estimated 8.3 million mt. The estimate for corn is a 600,000 mt improvement mom to 21.8 million mt.

- In France, their AgMin sees an increased wheat area for 2013 at 4.97 million ha (up 2.2% yoy), barley area is down 5.5% yoy at 1.59 million ha.

- The recent outbreak of bird flu in China is reported to have claimed additional lives with the total reported at eight. According to Reuters, a total of 28 cases are being reported from the latest variant of the disease. The outbreak does appear to be having an impact upon poultry consumption, albeit one we can not quantify at this time, and we would expect ingredients (soybean meal) to be similarly impacted with the appropriate knock on effect on prices. This is only likely to become significant if the outbreak becomes widespread, although some are questioning what the substitute for poultry meat is in China and whether the consumption pattern will resume its more traditional course as time moves on.

- Tomorrow’s April WASDE report was expected to have something of a limiting effect on CBOT markets today, soybeans currently stand in positive territory as does corn, the cold conditions which are delaying plantings will no doubt add to the positive sentiment, as does the prospect of Chinese corn imports resulting from their cold and wet weather delayed plantings. Wheat is trading a touch lower, presumably as a result of the slight condition improvement.