- We close the week in a slightly more upbeat mood as the last few weeks of sub-zero (in ℃ terms) temperatures give way to warmer conditions and the extremely late signs of spring arrive at long last. Evidence of increasing levels of fieldwork in dryer soils is growing, and we would expect a fairly rapid rise in soil temperatures to aid crop development.

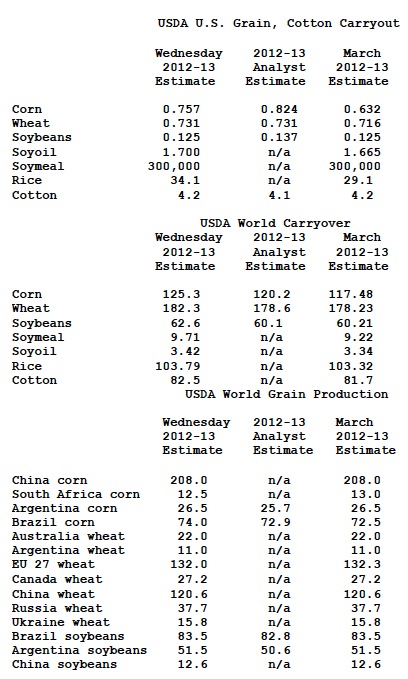

This week’s WASDE figures, released Wednesday, were not bearish as expected by some. However, the prevailing post report mood is very much one of “hand to mouth buying” and despite the potential warning signs, few are prepared to get bullish on old crop positions at present. The potential offered by large, and possibly record, crops in coming months appear to be offering comfort to consumers. We are aware that many European feed businesses are in a position of low levels of old crop cover and given the signs of tight supply, could well face some surprises before the next harvest is under way.

This week’s WASDE figures, released Wednesday, were not bearish as expected by some. However, the prevailing post report mood is very much one of “hand to mouth buying” and despite the potential warning signs, few are prepared to get bullish on old crop positions at present. The potential offered by large, and possibly record, crops in coming months appear to be offering comfort to consumers. We are aware that many European feed businesses are in a position of low levels of old crop cover and given the signs of tight supply, could well face some surprises before the next harvest is under way.

- The Chinese bird flu outbreak continues to rumble on with headlines this week reading “nine dead out of 33 confirmed cases” of the human variant. Further cases have been discovered in birds in a number of live bird markets in Eastern China although the details are scant as is often the case in China. Precautionary culls of birds have taken place in at least one of the markets affected although subsequent discoveries do not appear to have attracted the same measures, at least according to reports received so far. This has resulted in a degree of nervousness in the soybean complex as uncertainty over Chinese consumption levels has caused many to retreat from the market.

- Wheat and corn markets have found some support as the freezing conditions continue to delay corn plantings and potentially damage wheat crops. Disappointingly, this week’s US wheat export numbers did not match up to the upper end of expectations which could have reached the 1 million mt mark if the ideas that China purchased 14 to 16 cargoes actually materialised. Corn prices have received a degree of support from WASDE’s lower than anticipated ending stock figure. All of the USDA’s weekly export figures were all within the range of trade estimates so no surprises there.

- We pick up on news that growers in the US are reluctant to sell given the on-going low temperatures, which are potentially delaying and damaging crops, as well as a degree of belief that the recently released stock numbers are “plain wrong”. Whilst we sympathise with their view, it must be remembered that “the market is never wrong”, buyers and sellers agree a price and trade, and therefore it MUST be right. Many a trader has lost money believing he is right and the market is wrong!

- Whilst the US cold weather remains in the headlines, the forecasts show that there is a change towards warmer conditions towards the end of the month. This is already evident across Northern Europe as night-time temperatures remain above 0℃ (32℉), and daytime levels approach double digits (10℃/50℉). This will prove a blessing to growers who are waiting for warmer soil temperatures to boost germination and crop development in what can only be described as a late season so far.

- Brussels granted wheat export licences totalling 377,254 mt this week (the lowest weekly total since 1st January 2013), which brings the season total to 17.579 million mt, 4.824 million mt ahead of this time last year (plus 37.8%). If the season’s remaining weekly exports were to be exactly the same as last season, it would bring the annual export level up to 19.578 million mt, and interestingly we have only had one smaller week of exports compared with last year since the beginning of December 2012 (which was the week of 26 February 2013, and that was 2,542 mt less than the prior year). Whatever happens in the remaining weeks we are heading for a big number; Wednesday’s WASDE estimate for EU wheat exports was increased by 1 million mt to 20.5 million mt, so at least they seem on the ball with that number!

- On the subject of WASDE numbers, Wednesday’s April EU end stocks figure was estimated at 0.5 million mt greater than a month ago at 10.04 million mt; principle reasons are due to 1.25 million mt greater beginning stocks, a reduction of 200,000 mt in production, a 0.5 million mt reduction in overall consumption together with the addition 1 million mt of exports. By way of comparison, Stratégie Grains wheat carryout figure was reduced in mid-March from their February estimate by 200,000 mt to 10.7 million mt.