- Whilst we in the UK bask in warmer temperatures this week, having seen little in the way of frost, wheat markets have turned lower; old crop is down £4.75 (Jul ’13 19 Apr to 25 Apr) and new crop contracts have lost as much as £5.45 over the same period (Mar ’14). Paris contracts have also eased with the main feature being the premium to the London contracts holds over MATIF in the new crop position. Mar and May ’14 London compared with a Sterling adjusted MATIF are more than £11.00/mt over the Paris contracts. This is, no doubt, a reflection of the continued import parity pricing likely to be in place for a subsequent season.

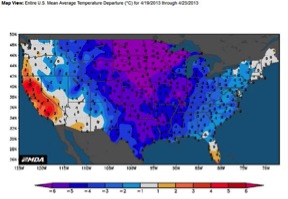

In contrast, the US has continued to suffer further cold and freezing conditions raising fears for their wheat crops and delaying corn planting almost to record late dates. In addition, the exceptionally late snow cover across Canada and US is set to create flooding as warmer weather arrives. It would appear likely that there will be a rapid onset of higher temperatures given the fact that the season is later, the sun higher in the sky, and a slow orderly thaw benefiting soil moisture is less likely than potential flood conditions.

In contrast, the US has continued to suffer further cold and freezing conditions raising fears for their wheat crops and delaying corn planting almost to record late dates. In addition, the exceptionally late snow cover across Canada and US is set to create flooding as warmer weather arrives. It would appear likely that there will be a rapid onset of higher temperatures given the fact that the season is later, the sun higher in the sky, and a slow orderly thaw benefiting soil moisture is less likely than potential flood conditions.

- One impact of the cold conditions in the US has been that corn planting has started slow, with only 4% of the crop in the ground as of last Sunday. This is some 14% behind the five-year average, although improved forecasts would leave us to expect a rapid pace as soon as conditions permit. The correlation between planting date and final yield is not fully proven but 10th May is an oft-used “cut-off” date, and that is approaching fast. Perhaps more important is the fact that harvest will most likely not be early, and this year, with extremely tight stocks, is hardly the best of timing.

- This week’s US export figures were disappointingly low, missing trade estimates by some considerable way. We have seen evidence of ever increasing cash basis levels, particularly in soybeans which could be one of the underlying deterrents to additional export sales as many US consumers are having difficulty with origination right now. It is reported that levels as high as $1.10 over July futures has been paid, a further increase on last week’s near record levels. Tight supplies and reluctant sellers have combined to create the explosive cash premiums.

- EU wheat export certificates were issued for 288,201 mt, which is lower than recent weeks, but still close to 5 million mt ahead of the same time last season (37.5%). One explanation for this was that the US was cheaper, although that was not borne out by actual sales from the US! The return of Ukraine to the global market following the removal of their export cap was not the opening of floodgates either, it is expected that only around 200,000 mt will be exportable as domestic prices are higher than can be achieved by exporters.

- The continuing bird flu story in China is perhaps rising a notch on the concern scale; the H7N9 variant is now said to have infected 108 people and killed 22. According to the WHO, the new strain is “one of the most lethal” viruses although human-to-human transmission has not, as yet, been proven. Reports of a Taiwanese traveler returning home after visiting China testing positive for the virus were circulating earlier in the week. This is the first reported case of the infection outside mainland China. Concern over a further mutation of the virus that would allow human-to-human spread is high. There are also a large number of what we believe to be highly speculative reports circulating in which there are claims of huge declines in poultry meat consumption. We take these with a pinch of salt at this time, and note that crush margins in China remain high, at least for now.