- The week’s news has largely revolved around the US weather scene, which continues to present an unfavourable picture with continued cold and wet conditions associated with a closed low that is positioning itself over the US Corn Belt. As a result, corn plantings are delayed with no widespread relief from this pattern in the near-term forecast. Meanwhile, some of the winter wheat crops have been subjected to a series of freezes, which could impact yield also. Spring wheat plantings are also being delayed. Overall the “top picture” does not look fantastic right now, but we must bear in mind that there is a long way to go before harvest is even considered and nature has a wonderful way of compensating for the inevitable difficulties it encounters in a season.

- In terms of market impact, we have seen new crop corn (Dec ’13) move from last Friday’s close $5.23⅞ to finish Thursday at $5.58⅜, a rise of nearly $0.35/bu. In terms of old crop corn we are seeing the front month premiums growing with May ’13 over $0.35 ahead of Jul ’13, reflecting the tightness of supplies and reluctance of sellers to part with stocks. Cash premiums remain solid as buyers attempt to persuade sellers to come forward.

- The soybean market displays similar notes with the May ’13 premium reaching record levels over the Jul ’13 contract. In the first two days of the week we saw old crop beans gain over $0.50/bu only to give much of that back on Wednesday before beginning to climb once again.

- In terms of driving forces it is probably fair to say that Chinese demand for old crop US soybeans is drying up fast as the flow of Brazilian supplies picks up. Latest trade data would lead us to believe that over 7 million mt of soybeans were shipped in April, maybe a touch lower than originally estimated but more than double the volume moved in March. This is clearly moving the focus away from US tonnage.

In addition there is the impact of bird flu in China, the BBC has reported that all provinces in the country are affected and, with 120 people affected and 26 dead, clearly this does not appear to be a “one minute wonder”. The WHO continues to warn of the seriousness of the threat to human health and whilst not transmissible from human to human (yet), the virus has displayed two of the five mutations required to make this happen. Should such an event occur, the WHO further warns of the potential for a pandemic of greater proportion than has been previously exhibited by any other flu variant.

In addition there is the impact of bird flu in China, the BBC has reported that all provinces in the country are affected and, with 120 people affected and 26 dead, clearly this does not appear to be a “one minute wonder”. The WHO continues to warn of the seriousness of the threat to human health and whilst not transmissible from human to human (yet), the virus has displayed two of the five mutations required to make this happen. Should such an event occur, the WHO further warns of the potential for a pandemic of greater proportion than has been previously exhibited by any other flu variant.

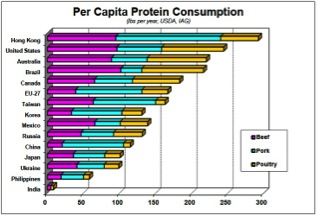

- Many stories follow on this theme with varying reports on the decline in chicken meat consumption, as much as 80% reduction being cited by some. There are also bizarre reports of rat and small mammal meats being passed off as mutton in the country which is searching for an alternative to poultry protein – we will leave readers to decide for themselves as to the attractiveness or otherwise of such a culinary delight!

- More seriously, the impact on soybean meal consumption must be an issue going forward. Unless the virus is stopped in its tracks by the imposition of some fairly draconian measures, culls and exclusion zones around infected areas, the spread will continue to grow. How this plays out in coming weeks will be key in determining the requirement for soybean meal. We are watching with growing interest.

- Finally, Brussels granted EU wheat export certificates for 338,588 mt, which is ahead of last week and brings the cumulative volume up to 18.641 million mt, 5.15 million mt ahead of last season (38.1%).