- HEADLINES: May Chicago soybean futures push above 50-day moving average; Brazilian Dec-February weather; Future Mexican corn import demand.

- Chicago values are mixed at midday with the grains weaker and soybeans firmer. There was solid volume on the morning reopening, but activity following the first 30 minutes dried up. Grains have a mixed tone while soybeans feel supported at midday with the charts providing clues for the close.

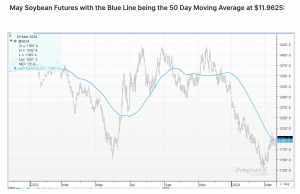

- Traders are watching to see if May soybean futures can close above their 50-day moving average at $11.9625. Soybeans have been flirting with the 50-day with rallies above and breaks below over the past 5 trading sessions. However, May soybean futures have been unable to close above this resistance. The last time that May soybean futures were able to close above the 50-day moving average was back on December 11. The chart pattern that is forming is a bull flag with breaks to support at $11.70-11.80 uncovering fund short covering. Key for Chicago going home is whether May soybeans can finish above $11.96.

- World wheat futures are under pressure from the sizeable amount of wheat offered to Egypt’s GASC in today’s tender. We counted 34 separate offers for the May 5-15 shipment period which reflects the abundance of Russia/European old crop supply. The cheapest fob wheat offer was Bulgarian wheat at $232.50/mt. US/Paris wheat futures are in decline on the remainder of large old crop wheat availability. World wheat futures declined based on this availability. However, new crop supplies are becoming more important with each passing day. The ongoing wet weather pattern for W Europe and dryness across the Black Sea is gaining attention, but it is far too early in the growing season to cut yield or planted acres. That becomes possible in April/May with a static pattern.

- Chicago brokers estimate that managed money has sold 5,100 contracts of wheat and 3,100 contracts of corn, while buying 3,600 contacts of soybeans. In the soy products, funds have bought 3,000 contracts of soymeal and 1,200 contracts of soyoil. Funds are holding sizeable net short positions in soybeans/soymeal.

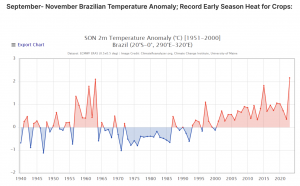

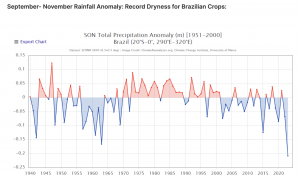

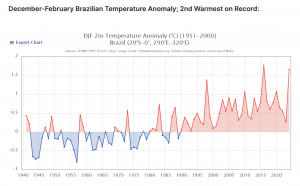

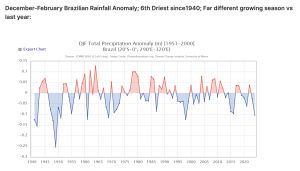

- We have been reflecting on the record large 8.2 million mt disparity of public crop estimates between CONAB and USDA on the 2024 Brazilian soybean crop. We have no way of knowing which is correct, but we are attaching seasonal temperature and rainfall anomalies for the growing season broken down into 2 quarters, Sept-November and December-February. All that can be said is that this year’s 2023/24 Brazilian growing season was the warmest on record and one of the driest. Under this growing weather, USDA is forecasting Brazilian soy yield to (50.2 bushels/acre) be down just 3.7% vs trend and down 6.9% from last year’s record.

- US weekly ethanol production totaled 308 million gallons, up 5% from last year and on pace for WASDE to raise their 2023/24 US corn grind to 5,400 million bu. Amid the inclusion of E15 year round across the Midwest, the 2024/25 US corn grind could reach a record 5,475 million bu. Seasonally, ethanol prices rise into June.

- The US ag attaché in Mexico released their balance sheet on Mexican corn demand, imports, and usage for the 2024/25 crop year. The report expects that Mexico will import a record 22 million mt of corn in 2024/25 on surging feed demand. This would be a record 865 million bu of corn that would come mostly from the US. In coming years, Mexico could become the world’s largest corn importer.

- The US Central Bank will update their interest rate policy near the Chicago close. We expect that they will keep rates higher for longer based on stubborn inflation and the difficulty of the last mile to getting inflation beat down to their 2.0% target. Watch the US dollar and how it reacts to the US Central Bank policy. We look for US weekly export sales to be poor for wheat on the already announced daily Chinese cancellations. Soybean sales will be poor on competition. US corn and soymeal sales should be solid. Note that US soymeal continues to be shipped with limited switching to Argentina with a record 3.4 million mt of open US meal sales on the books. March corn futures have now traded at $4.39 for the past 10 trading days. We look for additional short covering into the USDA March 28 Stocks/Seeding Intentions report.