- HEADLINES: Wheat recovers on soaring European market; Row crops struggle.

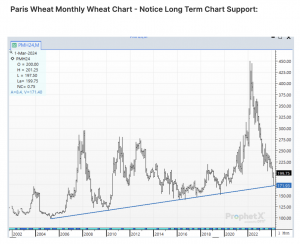

- Wax on/Wax off! Chicago grain futures are mixed at midday with corn and soybean in the red and wheat futures following the EU market higher. Based on midday Chicago values, March corn prices are virtually flat for the week at $4.395, May soybeans are down 3 cents (last week’s close at $11.9825) with May Chicago wheat up 23 cents at $5.51. Chicago wheat has traded within last week’s range, which makes a break above or below this week’s high or low important. We note that long term monthly wheat charts in Paris and Chicago reflect strong support below current values, and it appears that wheat is trying to forge a seasonal low. The choppiness of Chicago trade has been fully expected as a key NASS Crop Report is due next week Thursday. US farmers will tell NASS that their total seeded acres will be down 2-3 million acres from last year due to a lack of profitability, it is just how much of a rotation out of corn into soybeans/cotton will be uncovered.

- Traders are also expecting a sharp fall in net short managed money positions in corn, soybeans, wheat, and soy products. Whether this fall occurs will be key to next week’s trading. The managed money crowd will bank profits heading into the end of the month and quarter. Brazilian farmers were active sellers of recently harvested soybeans and corn which was hedged on the early week Chicago rally. It is still the case that neither rallies nor breaks are able to be sustained.

- The USDA announced that 263,000 mt of US corn was sold to Mexico. 173,000 mt was for the 2023/24 and 90,000 mt for the 2024/25 crop year. Mexico is the largest US corn importer and has secured more than 18 million mt of US corn to date. Mexico is forecast to import 20.6 million mt of US corn in the 2023/24 crop year. Pace analysis suggests that Mexico could import 22 million mt of US corn.

- Chicago brokers estimate that the managed money has sold 6,300 contracts of soybeans, 4,700 contracts of soyoil, and 4,100 contracts of soymeal. In the grains, funds have sold 5,100 contracts of corn and 3,600 contracts of wheat.

- Low grain prices are straining farmers across the world including Brazilian farmers where bankruptcies are up 534% and Russian farmers that will cut back in spring grain seeding due to negative margins. And Ukraine farmers are facing new crop corn bids that are near $100/mt or $2.60/bu off the farm. Even with the Ukraine government trying to provide free seed, the margin for its farmers is exceptionally low due to rising fixed and variable costs. The extended war is finally starting to take its toll. The first crop that will endure the smaller seedings due to its high input cost is corn followed by wheat. Soybeans and other oilseeds will be favoured along with fallow acres. Northern Plains and Delta farmers are shunning corn, while Midwest farmers are adding 5-10% more soybeans to save cost and reduce risk. The market is doing its chore in reducing new crop supplies through profit and price. Total US and world cropped acres will be curtailed this spring, which will elevate the importance of weather/yield.

- The midday GFS weather forecast is wetter in Mato Grosso, with 10-day accumulation there raised from 3-6” to 4-9”. Regional flooding is a concern in western Mato Grosso, but otherwise coming soaking rain across the northern half of Brazil’s safrinha corn belt is viewed as a positive. Longer term issues remain present, namely the probable return of warmth/dryness in April, but there will be no shortage of soil moisture in Mato Grosso, Goias and Minas Gerais nearby.

- We do note that rains into April 1 miss key areas of Mato Grosso do Sul and Parana, which combine for 30% of Brazilian safrinha output. Drought worsens there, and the need for rain becomes immediate beyond April 1. A major difference in corn crop health between northern and southern areas lies ahead.

- Late winter/early spring is typically a strong time of year, seasonally, for ag markets. This is due to the erosion on physical N Hemisphere supplies and the looming nature of the new crop growing season. Ongoing climate chaos is noted this year following incredible warmth in the Central US in Feb, only to be followed by massive snowfall in northern areas. The transition to La Niña leaves forward weather/supply less predictable. Choppiness continues into NASS stocks/seedings data next Thursday.

To download our weekly update as a PDF file please click on the link below: