- HEADLINES: USDA April report uninspiring, WASDE holds Brazilian soy crop at 155 million mt; Chicago choppiness to persist; N Hemisphere weather drives direction into May.

- The USDA April WASDE report was uninspiring. WASDE left its estimate of the 2024 Brazilian soybean crop at 155 million mt, implying that the spread to CONAB’s April estimate (released this morning) will widen out to a record large 8.5 million mt. WASDE has held a better track record in recent years, but such a large crop disparity will not be resolved until Brazilian export and crush data identifies which government agency is correct by September/October.

- WASDE left its Brazilian corn crop estimate at 124 million mt and decided to hold fast on their 2024 Argentine soybean crop forecast at 50 million mt but trimmed the Argentine corn crop by 1 million to 55 million mt. China’s 2023/24 soybean imports were unchanged at a record large 105 million mt.

- The Brazilian corn crop estimate spread (WASDE vs CONAB) is 14 million mt, while two Argentine commodity exchanges argue that WASDE is too high on its corn production by 2-4.5 million mt for a total of 16-18.5 million mt. Admittedly it will require additional time and harvest data to better understand Argentine corn stunt disease. But from a market perspective, the differences between S American crop estimates are massive for April.

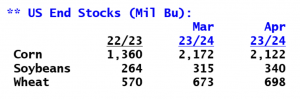

- The USDA raised feed/residual use and the ethanol grind by 25 million bu for a bump in total US corn demand to 14,605 million bu. We argue that WASDE is still too low on its annual feed/residual estimate by 50-75 million bu. No change was made to US 2023/24 corn exports related to the limited change in S American corn supplies. The average US cash farmgate price is $4.70/bu.

- US 2023/24 soybean exports were cut 20 million to 1,700 million bu on the slow export and sales pace. No change was made on the US crush rate which is surprising considering record large monthly crush data. The March crush rate will now loom large for the May WASDE report. WASDE trimmed US soybean imports by 5 million bu and adjusted seed/residual down by 11 million bu. The average farmgate price eased by $0.10/bu to $12.55.

- US soyoil stocks rose by 45 million pounds on a modest gain in production of 45 million pounds while imports rose 50 million pounds while exports gained a like 50 million pounds. The net result was 2023/24 US soyoil end stocks at 1,627 million pounds, up 45 million pounds from March.

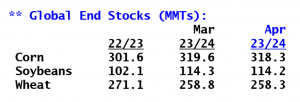

- Global end stocks of corn, soybeans and wheat were virtually unchanged from March with only modest adjustments in demand. Global corn and soybean stocks are large, but wheat stocks are forecast to decline in 2024/25. The USDA April reports will not hold the attention of the market beyond today. Unfortunately, choppiness is likely to persist until there is a clear supply risk via weather.

- April WASDE wheat data leans slightly bearish as US residual use was trimmed by more than expected. 2023/24 US feed/residual was cut 30 million bu, with US end stocks raised to 698 million bu, vs. 673 million in March. Imports were lowered 5 million. We view USDA’s lowering US feed/residual as too aggressive, but this debate will go unresolved until end stocks are published in June. The additional old crop supply provides a buffer against weather/yield issues, but we note that it was spring, white and durum balance sheets that loosen. US SRW stocks were left unchanged at 119 million bu, and it remains that record yield is needed to prevent SRW stocks contraction in 2024 due to lost acres. US HRW end stocks were lowered 5 million to 277 million bu.

- Exporter wheat stocks increased 1 million to 61.6 million mt. 2023 European production was raised 500,000 mt. Stocks in Kazakhstan were increased 500,000 mt amid lower projected export demand. That US and exporter stocks were lifted isn’t bullish of price today, but nothing in USDA’s April report was market changing. We maintain that the exporter balance sheet tightens in crop year 2024/25 amid reduced carryover and as production will be steady/lower amid lost winter acres in the US and W Europe. The duration of dryness in the US Plains and Black Sea remain top priority.

- World ag markets’ reaction to USDA’s report is understandably muted. N Hemisphere is a big deal amid CONAB’s commitment to sharp declines in Brazilian output and an Argentine corn crop no bigger than 52 million mt due to disease pressure. Funds are carrying a record large net short position in the 2024 growing season. Don’t take your eye off Mother Nature!