- The markets have today all traded lower with funds being noted sellers in the soybean complex as well as in grains. The inability of the Nov ’13 soybean contract to push into new highs has been cited as the trigger for selling of a technical nature. As ever, the grains tagged along with the decline.

- Egypt’s GASC once again secured wheat in their most recent tender, this time for October 21-31 shipment. Russia secured 120,000 mt and Romania the balance of 60,000 mt. This brings Egypt’s 2013-14 procurement to just over 1.9 million mt, and is the third such tender within eight days. Perhaps of interest is the growth in tonnage secured by Russia who were noticeable by their failure to secure early tonnage in Egypt’s tenders. France, once again, was too expensive and failed to secure a sale.

- The Reuters crop forecasting arm, Lanworth, once again cut its forecast for US corn and soybean output as a consequence of hot and dry conditions. Corn was forecast at 13.33 billion bu with yield at 151.6 bu/acre, which is a reduction from 13.406 billion bu and 152.4 bu/acre. Soybeans were predicted to yield 40.4 bu/acre with a total output of 3.114 billion bu, which compares with 40.8 bu/acre and 3.14 billion bu last estimated. In the same report they increased global wheat output to 701.84 million mt (3 million mt increase month on month) based upon improved prospects for crops in Russia, Canada, Kazakhstan and Argentina, which are expected to offset the poorer outlook in Australia.

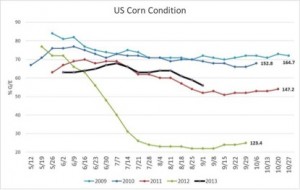

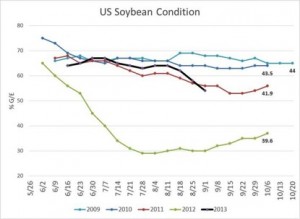

- Much has been talked of the US weather conditions of late. The season started late with unusually wet conditions delaying seeding in sodden fields, although some heroic efforts were made by farmers to catch up when conditions allowed. Crops (corn and soybeans) became tested as conditions moved towards the now all too familiar dry state. We are all familiar with the adage that corn crops are made in July, and soybeans in August; helpfully for corn, the dry spell only really kicked in in late July, which means that the corn crop has escaped the worst yield influencing impact of the dry weather. More concerning is the August dryness which is impacting soybean crops.

- Yesterday’s (Tuesday) crop condition report showed corn good/excellent rating on 56% of the crop, much as expected, down from 59% the previous week and way ahead of last year’s drought hit 22%.

- The condition of the soybean crop was reported as 54% good/excellent, again this was as expected, down from 58% week on week but an improvement on last year’s 30%.

- It must be remembered that last year’s drought hit much earlier and the corn crop suffered in the key pollination stage of growth, and that late rainfall (in August) boosted soybean output – see old adage above! Regardless, the outlook for both soybean and corn output remains above that of last year.

- S America soybean stocks are reducing swiftly as the strong pace of world demand (China) boosts exports. August soybean exports from S America rose by nearly 4 million mt year on year, with Brazil accounting for 3 million mt and Argentina 0.9 million mt. September export volumes are also expected to be higher than last year, largely as a result of low availability of US stocks and late availability of new crop due to the likely lateness of harvest. The key question will be, “Can the US deliver sufficient volume of soybeans to export locations to satisfy global import requirements from October?”