- Midday comments:

- EU and Russian harvest pressure continues to weigh on international wheat prices despite the imposition of new sanctions on a number of Russian state banks which may heighten the geopolitical risk in the region. The Russian AgMin has estimated that the grain harvest so far stands at 45 million mt with an average yield of 3.43 mt/ha, which compares with 35.5 million mt and 2.79 mt/ha last year. Estimates of a Russian harvest as high as 59 million mt are circulating widely, compared with the USDA’s latest at 53 million mt, which could spark yet more aggressive pricing on international markets. In Ukraine there appears to be a building backlog of wheat which may well come to market anytime soon as output estimates rise. Some private estimates stand at 57.4 million mt (grain output), about 4% ahead of last year, wheat accounts for 21 million mt, up from 20.5 million mt last year.

- EU prices continue to decline with MATIF Nov ’14 hitting a new low and prices as low as we have seen in four years. Egypt came to the market last night, after the close, for mid-September shipment, and we again believe France will be absent on quality grounds. Russia is expected to be aggressive, and Romania and Ukraine may well make a showing whilst US may offer but freight will likely kill it.

- Morocco has cut its soft wheat import duty to 17.5% from 45% with effect from September 1st.

- Corn market fundamentals show little sign of demand expansion right now with lower cattle on feed numbers and in line with expected ethanol demand projections; this leaves a question mark over USDA export numbers which may well need to be reviewed in the August report – downwards and bearish! The fund position, which is a small net short, coupled with further long liquidation or adding to shorts will pressure prices, and any bearish August weather will keep pressure on the downside. The forecasts for this week remain dry for the rest of this week but show good agreement with wetter conditions across much of the corn belt early to mid-next week. Temperature remains a non-issue.

- A private forecaster has put Ukraine corn production at 27 million mt, up around 4% from last year and should see the country a key exporter despite political tensions in the region.

- Soybean markets have seen something of a selloff as the forecasts contain needed rains and funds continue to add to their net short position. The ongoing lack of heat in front of coming rains has ensured limited crop stress and the potential rain in the key August period is seen as bearish. A further bearish input has come from some showery weather in central Brazil, which is not typical, although very welcome. Whilst providing a delay to corn harvest it has added a shot of moisture ahead of the soybean planting season which is no bad thing. Bean planting typically starts around mid-September, and with corn prices in Brazil below cost of production and with input prices rising sharply, we would expect to see a big swing in acres away from corn and into soybeans.

- US soybean exports and soybean meal demand remain strong, which will keep cash bids firm and provide some market underpinning despite producer selling in both Brazil and Argentina on the last price rally.

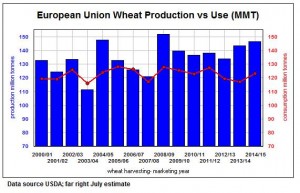

- The latest update on EU wheat production looks set to confirm wet weather damage reducing quality supplies and correspondingly increasing the feed pile as well as overall output set to top 147 million mt (including durum) making the 2014 harvest the third largest on record. France, the EU’s top producer and exporter, has suffered the worst of the weather effects as we have reported previously. July rainfall reaching as much as three times normal has been described as “relentless”, and Stratégie Grains have pegged soft wheat output for France at 37 million mt, above the five year average.

- Germany, the second largest EU producer of wheat, is also expecting a favourable crop but also some quality issues. Output at 25.6 million mt would rank as fourth best in the last 15 years. The UK, EU’s third largest producer, has not (yet) suffered the weather ravages seen by others and is looking for favourable weather to boost wheat supplies after two poor years of production. Poland, ranked fourth in the EU, is anticipating output of 9.6 million mt to equal last year’s production. Latest weather forecasts suggest that rain is expected to taper off in N Europe in the coming week although strong showers are anticipated in S Europe, which will continue to hamper harvest efforts in Romania, Bulgaria and Italy.

- Evening update:

- CBOT markets have been mixed (to say the least) with closing prices lower in soybeans and meal with the grains posting gains. Clearly there is nervousness to sell beans hard until such time as the wetter weather is confirmed yet rallies are struggling to fight improved weather prospects – a typical weather market.

- Egypt secured 175,000 mt of wheat exclusively from Russia a couple of dollars lower than last week with the next best offer coming from Ukraine only just more expensive. US soft red was around $8.00/mt too dear freight included and French was noticeably absent.

- News from China suggests that barley and sorghum imports may well be slowed down, or even halted, due to tighter pesticide restrictions. The real deal is that China needs limited grain imports in the light of record corn and wheat production, and this is their way of ensuring they control supplies effectively! It is likely that restrictions on feed wheat will follow before too long.