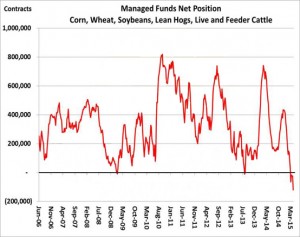

- Traders have expressed concerns that fund managers are holding a record short position in combined agri commodity positions heading into a new growing season. If there was a weather spark – a supply dislocation – grain and oilseed prices would likely rally, potentially sharply. The problem is that today such a weather spark is lacking and may not develop until late May or June when the reproductive period for summer row crops comes into focus. Funds have held record large short positions in other markets such as the €uro in recent months, and this produced accelerations in downtrends – not reversals. The key is watching weather for any sign of threat that would force funds to rethink their bearish stance.