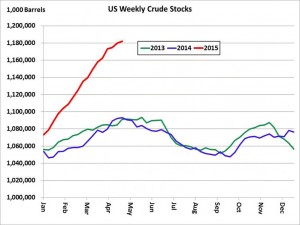

- US crude oil stocks are rising to record highs – yet the market does not seem to care! Spot WTI futures are testing key resistance at $60/barrel and the rally has supported a view that frackers should get back to active shale gas production.

- China has been an active crude importer as they put away cheap reserve stocks, but the world still has a huge supply imbalance that needs to be corrected. This can only be accomplished through the message of curtailed production, and this requires lower prices.

- It feels doubtful that June WTI can muster a rally much above $60-62.00 and we would be sellers above this level.