- Chicago has seen the grains decline, wheat substantially, and the soybean complex making gains with funds seemingly securing bean oil in volume on the back of the rally in crude oil. This is the second day of fund buying in bean oil, and such events rarely last more that three days. The sagging grain prices and additional poultry flock infection with avian influenza, which will likely impact meal demand, should weigh heavier on the soybean complex before long.

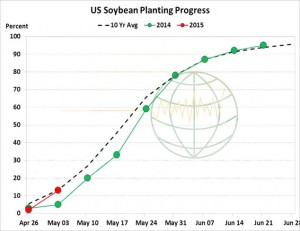

- NASS, the USDA’s National Agricultural Statistics Service, reported US soybean planting progress at 13% completed, up 11% from last week and 4% ahead of the 5 year average. Planting across the W Cornbelt will slow this week, but the E Midwest and Delta will have chances to push US soybean seeding to 20-24% next week. Our view is unchanged with soybean futures to work lower on favorable weather and expanded US seeding, as well as the bearish tug of the grain markets.

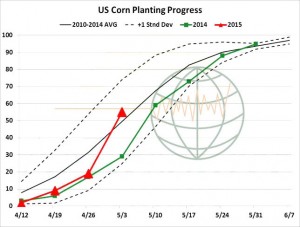

- US corn seeding as of Sunday reached 55% completed, vs. 19% a year ago and 38% on average since 2010. 32 million acres were put in the ground and note that this week’s advance of 36% is the third largest on record. Not many more warm/sunny days are needed to complete seeding in IL and IA. Delta producers will make great strides amid continued warmth/dryness there. It in not unreasonable to project seeding to reach 70-73% completed as of May 10th, vs. 60% on 5 year average. Northern Hemisphere weather is favorable, planting concerns are all but dead in the US, and the issue moving forward is the need to boost export demand. Decent sales will continue into June, but our concern is the huge competition for trade in Aug-December and 2015/16 US stocks reaching 2 plus billion bul. Our immediate downside price target for July is $3.50/bu.

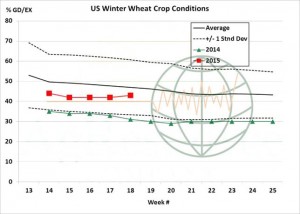

- US wheat good/excellent ratings as of Sunday were posted at 43% (a 1% gain on the week) vs. 31% last year. Notice below that conditions this year are diverging from last year, which will be a theme into late May amid ongoing precipitation and non-hot temperatures. Ratings in KS and OK are up 1%. Other notable improvements occurred across; CO, IN, MO and OH. SD good/excellent is down 3%. Spring wheat seeding is 70% complete, vs. 40% a year ago. The spring crop is 30% emerged and winter wheat is 43% headed. Both are well ahead of last year. US wheat competes against EU origin for June arrival below $4.70 basis July Chicago, but US offers thereafter are not competitive. Normal precipitation and temperatures are projected across Europe, Russia and China into late May. Our strategy remains to use short covering rallies to extend 2015 and 2016 sales with seasonal lows pegged in a range of $4.25-4.50 in early summer.

- Reuters reported today that Russia’s Agricultural Ministry has proposed lifting its wheat export tariff from 15th May and for the government to set a new formula for the payment. For guidance, the current tax is 15% of customs price plus €7.50, but a minimum of €35/mt. This move, if acted upon, could release as much as 8 million mt of wheat into the “available for export” category, and it is this which is likely pressuring prices lower at present.

- Egypt, in a surprise tender, secured a further 120,000 mt of wheat for June 16-25 shipment at an average price of £205.75 C&F, which is well below the $221.39/mt paid at the last tender on 18 April. Russia and Romania each won 60,000 mt continuing to point to their ability to compete in the international tender market. The purchase did not tell is the whole picture though, the volume of offers was big, particularly from Russia, and included US (expensive), French (expensive) and Polish (expensive) in a big offer lineup. The Russian volume may well be an indicator of what is to come when their tax is finally lifted!

- Informa Economics today released their latest estimate for the 2015 US wheat crop. They put winter wheat output to 1.486 billion bu from 1.497 billion with hard red winter wheat at 871 million bu and soft red winter wheat at 410 million bu. They declined any further explanation or commentary!

- Finally, having been extremely busy this Bank Holiday weekend, our latest stab at EU and Black Sea corn S&D’s follow, ahead of next week’s USDA new crop report.