- Having just returned from performing my civic duty it is now important to keep busy and not gnaw my fingernails to a stump in anticipation of the election outcome, or should I just go back to sleep?

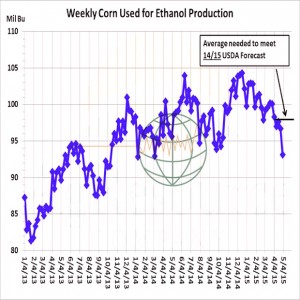

- Yesterday saw a “bounce” as we discussed, is it fundamental? – We think not at this time. One fundamental, which impacts markets is US ethanol production and this is in sharp decline – even though production plant profits are rising – as seasonal downtime is being taken for maintenance. The chart to below reflects that the weekly grind needs to average around 97 Mil Bu in the weeks remaining in the old crop year. Otherwise, WASDE will be forced to lower their annual US corn used for ethanol production figure by 20-40 Mil Bu. Since US corn feed use is (at best) likely stagnant and US corn is not competitive against South America, the US corn market lacks a demand driver. Without adverse Central US weather, any rallies are either short covering or bounces and will likely fail.

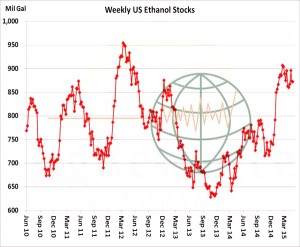

- In terms of actual ethanol stocks, whilst weekly production may well be in decline and is seen at a pace well below that needed to meet the USDA’s target, stock levels remain well above last year, and that is despite rising blending margins. Last Friday stocks were 872 million gallons, just 1 million down week on week. Additionally, US gasoline stocks grew 400,000 barrels and remain some 7% above last year. As previously mentioned, S American corn is a discount to US supplies with bigger Brazilian discounts evident in August. The theme of increased export competition and stagnant US demand growth continues. We will doubtless see short covering rallies, particularly if fund net short positions are high, but any lasting advance in corn prices (without a serious weather issue) look hard to justify.

- Enjoy polling day!