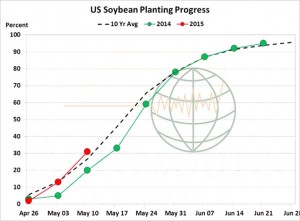

- NASS reported planting progress last week advanced to 31%, up from 13% last week and also above the 5 year average of 20%. Rain delays across the Cornbelt look to continue in the first half of the week, followed by a warmer/drier trend into the weekend. Ahead of the May WASDE, the average trade estimate calls for old crop soybean stocks to decline by 10 million bu to 360 million – but still at an 8 year high. New crop stocks are projected even larger at 443 Mil Bu. Our long-term price outlook calls for a further decline in both old and new crop values, with July to fall to $8.50-9.00 in coming weeks.

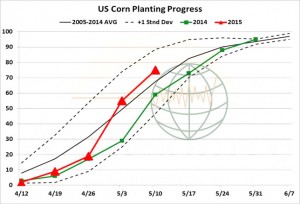

- Planting progress through to Sunday exceeded expectations, and with two decent windows available to finish planting in the next 10-12 days the crop will likely be fully seeded by late May – and USDA on Tuesday is likely to boost yield 1-2 bu/acre above the Outlook Conference guess. Planting as of Sunday reached 75% complete, slightly better than the trade’s guess and compared to 55% a year ago. Seeding is especially advanced across the Northern Corn Belt, where in MN 90% of the crop is in the ground. Early season frosts scare will not carry as much weight in 2015. The crop is 29% emerged, and initial condition ratings are likely to be released on May 25th. As for the May WASDE, no changes are expected in the old crop balance sheet. New crop stocks will be pegged near 1,850 million bu, and major exporters’ new crop stocks/use will be higher – which is growing in importance as the US loses world market share. Key technical support rests at $3.55 basis July ’15 contract.

- The market last night was just marking time ahead of Tuesday’s WASDE release, which will provide a preliminary look at the 2015/16 global wheat surplus. Winter wheat good/excellent ratings rose 1 point to 44%, right at trade expectations, and compared to 30% a year ago. Improved conditions are noted in ID, IN, MI, NC, OH and TX; declines were limited to MT, OR and WA. Tomorrow’s first US winter wheat production estimate is expected to exceed 2014’s crop by 70-100 million bu Spring wheat seeding is now 87% complete, with the crop 54% emerged and crop conditions are due next week. Amid weekend rainfall, we peg the season’s first spring wheat good/excellent rating at 70-75%, similar to last year. Otherwise, world cash prices are unchanged, with Russian origin by far the cheapest into August. A modest uptick in 2015/16 major exporter stocks/use is expected in the May WASDE, and there still is nothing to fuel a major short covering rally.